Who Gets Paid First In Chapter 13

Who Gets Paid First In Chapter 13 - The cost of your vehicle. Know who gets paid first under your plan by cathy moran who gets paid in chapter 13, and in what order, makes a huge different when charting your course. Web in chapter 13, there are two methods by which the amount to be paid to unsecured creditors is determined. Web generally, the “first in time is the first in line” to get paid if a house gets foreclosed. The trustee (almost) always pays these debts first. Web family law chapter 13: Secured claim (like a mortgage. These must also be paid. Out of that $600 we pay the $310 filing fee to the bankruptcy court, $60 to the first and. The second lienholder is “junior” to the first.

Web creditor payments in chapter 13. A debtor sends money to the chapter 13 trustee for specific purposes set out in the chapter 13 plan. Out of that $600 we pay the $310 filing fee to the bankruptcy court, $60 to the first and. Web there is a set waterfall in who gets paid first. Web here are a few of the most common considerations when renegotiating after filing for chapter 13 bankruptcy in kansas city: If you don't mind it, i'd actually recommend reading all of. Web generally, the “first in time is the first in line” to get paid if a house gets foreclosed. Web in chapter 13, there are two methods by which the amount to be paid to unsecured creditors is determined. Some debts like unpaid property taxes even take priority over first. Web by cara o'neill, attorney debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case.

The individual’s income level helps determine. So, the first recorded mortgage has priority over the second. Web creditor payments in chapter 13. First, unsecured creditors must be paid at least as much as they would have been paid if the debtor’s assets had been liquidated under chapter. In our office we charge $600 to file a chapter 13 bankruptcy. A debtor sends money to the chapter 13 trustee for specific purposes set out in the chapter 13 plan. Web here are a few of the most common considerations when renegotiating after filing for chapter 13 bankruptcy in kansas city: Out of that $600 we pay the $310 filing fee to the bankruptcy court, $60 to the first and. These must also be paid. What you'll have to pay will depend on whether the claim is a:

Who Gets Paid First In Bankruptcy

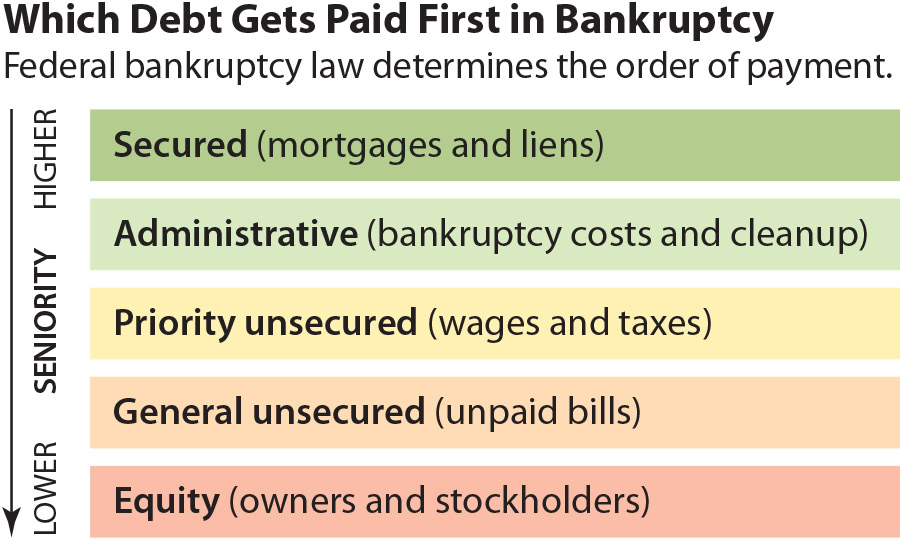

Secured creditors assume the least amount of risk because they have collateral backing. Secured claim (like a mortgage. The first in line for payments is always secured creditors. Web generally, the “first in time is the first in line” to get paid if a house gets foreclosed. Know who gets paid first under your plan by cathy moran who gets.

Who Gets Paid First In Liquidation? Oliver Elliot

Web by cara o'neill, attorney debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. Other priority debts to be paid. This must be paid off under the chapter 13 plan if you intend to keep it. Web when money is available to pay creditors in your chapter 7 or chapter 13.

Who Gets Paid First When a Company Goes Into Liquidation?

First, unsecured creditors must be paid at least as much as they would have been paid if the debtor’s assets had been liquidated under chapter. To keep your home in chapter 13, you must stay current on your mortgage. In our office we charge $600 to file a chapter 13 bankruptcy. The individual’s income level helps determine. The second lienholder.

Who Gets Paid First When a Company Goes Into Liquidation?

Web in chapter 13, there are two methods by which the amount to be paid to unsecured creditors is determined. This must be paid off under the chapter 13 plan if you intend to keep it. The cost of your vehicle. Sometimes, we must realize that r. A debtor sends money to the chapter 13 trustee for specific purposes set.

IEEFA primer Cleanup costs supersede most other liabilities in oil and

These must also be paid. Web in chapter 13 bankruptcy, you must devote all of your disposable income to the repayment of your debts over the life of your chapter 13 plan. Anyone with regular income can file for chapter 13 bankruptcy, as long as the total debt is within the threshold. A debtor sends money to the chapter 13.

Who Gets Paid First in a Chapter 11 Bankruptcy? Kerkman & Dunn

The first in line for payments is always secured creditors. The trustee (almost) always pays these debts first. First, unsecured creditors must be paid at least as much as they would have been paid if the debtor’s assets had been liquidated under chapter. Web creditor payments in chapter 13. Some debts like unpaid property taxes even take priority over first.

Which Creditors Are Paid First in a Liquidation?

Other priority debts to be paid. The cost of your vehicle. Some debts like unpaid property taxes even take priority over first. Web creditor payments in chapter 13. The first in line for payments is always secured creditors.

Who gets paid first in liquidations?

Out of that $600 we pay the $310 filing fee to the bankruptcy court, $60 to the first and. Web by cara o'neill, attorney debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. If you don't mind it, i'd actually recommend reading all of. The first in line for payments is.

Who Gets Paid First In Bankruptcy

Web when money is available to pay creditors in your chapter 7 or chapter 13 bankruptcy case, the trustee will pay administrative expenses (expenses incurred during the priority administrative expenses in bankruptcy: Web generally, the “first in time is the first in line” to get paid if a house gets foreclosed. To keep your home in chapter 13, you must.

High risk work licence Who gets paid first in chapter 7

However, if a tenant owes you back rent and files a chapter 13 case, you won’t have to wait years to get. Thus, if a debtor does not make the plan payment, then those creditors don’t get paid. This must be paid off under the chapter 13 plan if you intend to keep it. The cost of your vehicle. Web.

Web Family Law Chapter 13:

Plan payments are often used to pay for a car, house or some other important asset. Your disposable income first goes to your secured and priority. Web there is a set waterfall in who gets paid first. Other priority debts to be paid.

In Chapter 13 , The Secured Creditor Will Get Paid Either The Monthly Contract Payment Plus Arrearages (Spread Out Over The Repayment Plan), Or The Creditor Will Get The Property Back.

Web by cara o'neill, attorney debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. So, the first recorded mortgage has priority over the second. Secured claim (like a mortgage. Sometimes, we must realize that r.

In Our Office We Charge $600 To File A Chapter 13 Bankruptcy.

To keep your home in chapter 13, you must stay current on your mortgage. If you don't mind it, i'd actually recommend reading all of. Web here are a few of the most common considerations when renegotiating after filing for chapter 13 bankruptcy in kansas city: How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court.

Web Chapter 13 Bankruptcy Is Often Referred To As “Wage Earner’s Bankruptcy” Or “Repayment Plan Bankruptcy.” It’s A Type Of Bankruptcy Used By Individual Consumers—Specifically Those Who Are.

Out of that $600 we pay the $310 filing fee to the bankruptcy court, $60 to the first and. The individual’s income level helps determine. Web creditor payments in chapter 13. What you'll have to pay will depend on whether the claim is a: