2022 Form 7203 Instructions

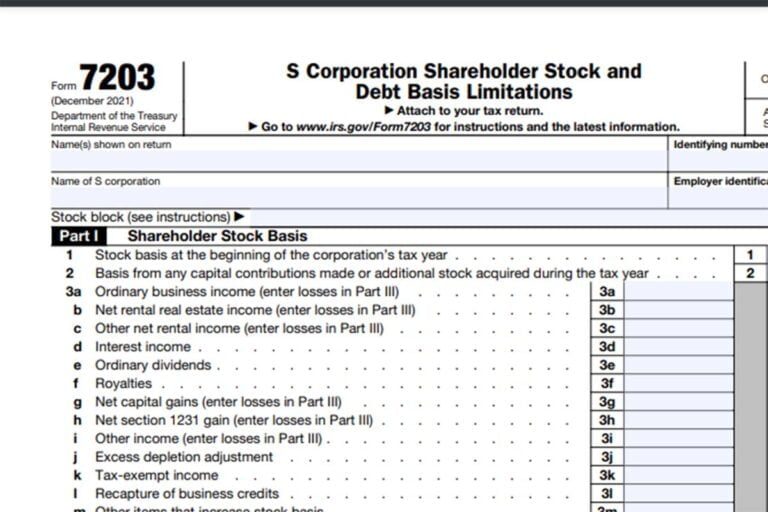

2022 Form 7203 Instructions - Basis from capital contributions made or additional stock acquired during year. S corporation shareholder stock and debt basis limitations 1221 01/18/2022 inst 7200 (sp) instructions for form 7200, advance. It replaces the prior irs 2018 worksheet that was. Web starting with the 2021 tax year, the irs has added new form 7203, s corporation shareholder stock and debt basis limitation. The draft form 7203 was posted by the irs on oct. Web instructions for form 7203, s corporation shareholder stock and debt basis limitations. S corporation shareholder stock and debt basis. Web form 7203 and the instructions are attached to this article. The new form replaces the worksheet. Web instructions for form 7203 (print version) pdf recent developments none at this time.

Basis from capital contributions made or additional stock acquired during year. Claims a deduction for their share. Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax returns. Web starting with the 2021 tax year, the irs has added new form 7203, s corporation shareholder stock and debt basis limitation. Web by turbotax•99•updated january 13, 2023. December 2022) corporation shareholder stock and debt basis limitations section. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Web s corporation shareholder stock and debt basis limitations stock block (see instructions) part i shareholder stock basis stock basis at the beginning of the corporation’s tax year. Form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's.

Inst 7200 (sp) instructions for form 7200, advance payment of employer credits due. Web the irs provides that the losses in excess of basis from closed statute years must reduce basis in the open statute year after considering the positive adjustments to. Web for tax year 2022, please see the 2022 instructions. Web by turbotax•99•updated january 13, 2023. Web instructions for form 7203 department of the treasury internal revenue service (rev. The new form replaces the worksheet. Web form 7203 and the instructions are attached to this article. Web 12/05/2022 form 7203: Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax returns. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury.

More Basis Disclosures This Year for S corporation Shareholders Need

The new form replaces the worksheet. S corporation shareholder stock and debt basis limitations 1221 01/18/2022 inst 7200 (sp) instructions for form 7200, advance. December 2022) corporation shareholder stock and debt basis limitations section. Web form 7203 and the instructions are attached to this article. December 2022) corporation shareholder stock and debt basis limitations section.

Form 7203 for 2022 Not much has changed in the form’s second year

December 2022) corporation shareholder stock and debt basis limitations section. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Claims a deduction for their share. Basis from capital contributions made or additional stock acquired during year. Web the irs provides that the losses in excess of basis from closed statute years must reduce basis in.

National Association of Tax Professionals Blog

Web instructions for form 7203 department of the treasury internal revenue service (rev. Web the blog discussed a new form, form 7203, s corporation shareholder stock and debt basis limitations. In short, form 7203 is a glorified basis worksheet. Web basis limitation (7203) stock basis at beginning of year this entry is mandatory to generate the form. Web instructions for.

IRS Issues New Form 7203 for Farmers and Fishermen

It replaces the prior irs 2018 worksheet that was. The new form replaces the worksheet. Web the irs provides that the losses in excess of basis from closed statute years must reduce basis in the open statute year after considering the positive adjustments to. Web instructions for form 7203, s corporation shareholder stock and debt basis limitations 1221 01/18/2022 form.

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

The draft form 7203 was posted by the irs on oct. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury. Web basis limitation (7203) stock basis at beginning of year this entry is mandatory to generate the form. Web instructions for form 7203, s corporation shareholder stock and debt basis limitations 1221 01/18/2022 form 7203:.

Form7203PartI PBMares

Basis from capital contributions made or additional stock acquired during year. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Web s corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: Web instructions for form 7203 department of the treasury internal revenue service (rev. Web.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web the irs provides that the losses in excess of basis from closed statute years must reduce basis in the open statute year after considering the positive adjustments to. Inst 7200 (sp) instructions for form 7200, advance payment of employer credits due. S corporation shareholder stock and debt basis limitations 1221 01/18/2022 inst 7200 (sp) instructions for form 7200, advance..

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax returns. Web s corporation shareholder stock and debt basis limitations stock block (see instructions) part i shareholder stock basis stock basis at the beginning of the corporation’s tax year. Web the blog discussed a.

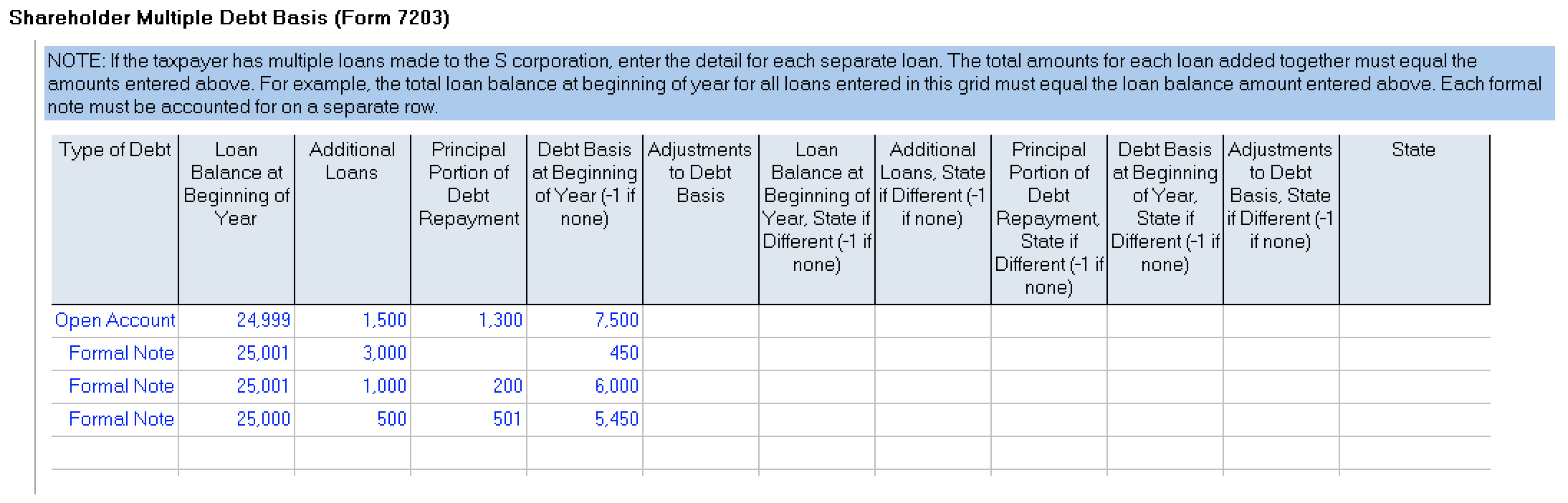

How to complete Form 7203 in Lacerte

The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Web the irs provides that the losses in excess of basis from closed statute years must reduce basis in the open statute year after considering the positive adjustments to. Other items you may.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

In short, form 7203 is a glorified basis worksheet. Web september 28, 2022 draft as of form 7203 (rev. Claims a deduction for their share. S corporation shareholder stock and debt basis. Web instructions for form 7203, s corporation shareholder stock and debt basis limitations.

Web S Corporation Shareholder Stock And Debt Basis Limitations Stock Block (See Instructions) Part I Shareholder Stock Basis Stock Basis At The Beginning Of The Corporation’s Tax Year.

Web the blog discussed a new form, form 7203, s corporation shareholder stock and debt basis limitations. Other items you may find useful all form 7203 revisions about form. Form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury.

Web Instructions For Form 7203 (Print Version) Pdf Recent Developments None At This Time.

Inst 7200 (sp) instructions for form 7200, advance payment of employer credits due. December 2022) corporation shareholder stock and debt basis limitations section. It replaces the prior irs 2018 worksheet that was. In short, form 7203 is a glorified basis worksheet.

S Corporation Shareholder Stock And Debt Basis.

Web september 28, 2022 draft as of form 7203 (rev. Web instructions for form 7203, s corporation shareholder stock and debt basis limitations 1221 01/18/2022 form 7203: Web instructions for form 7203 department of the treasury internal revenue service (rev. Web starting with the 2021 tax year, the irs has added new form 7203, s corporation shareholder stock and debt basis limitation.

Web By Turbotax•99•Updated January 13, 2023.

Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Claims a deduction for their share. S corporation shareholder stock and debt basis limitations 1221 01/18/2022 inst 7200 (sp) instructions for form 7200, advance. Web for tax year 2022, please see the 2022 instructions.