Az A4 Form 2023

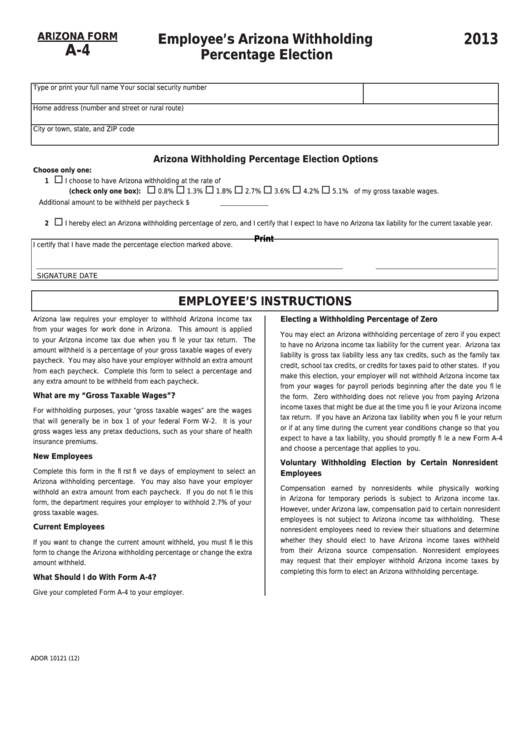

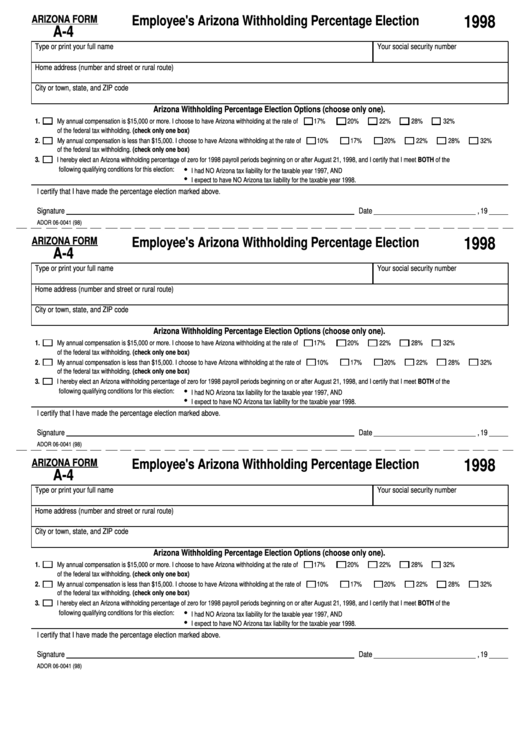

Az A4 Form 2023 - Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. Web this form is for income earned in tax year 2021, with tax returns due in april 2022. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web thursday, december 15, 2022. The tax rates used on arizona’s withholding certificates are decreasing for 2023. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Use a a4 form 2021 template to make your document workflow. You can use your results. File this form to change the arizona withholding percentage or to change the extra amount withheld. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department.

Choose either box 1 or box 2: Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web this form is for income earned in tax year 2021, with tax returns due in april 2022. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web 20 rows withholding forms. Use a a4 form 2021 template to make your document workflow. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. Web thursday, december 15, 2022. Form year form published ; The arizona department of revenue has.

Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Choose either box 1 or box 2: File this form to change the arizona withholding percentage or to change the extra amount withheld. You can use your results. 1 withhold from gross taxable. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. Use a a4 form 2021 template to make your document workflow. The arizona department of revenue has. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. Web 20 rows withholding forms.

Køb DIN 6797 rustfrit stål A4, form AZ online

1 withhold from gross taxable. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. As a result, we are revising. Web 20 rows withholding forms. The tax rates used on arizona’s withholding certificates are decreasing for 2023.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. 1 withhold from gross taxable. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. Form year form published ; Web 2 i elect.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. The arizona department of revenue has. The tax rates used on arizona’s withholding certificates are decreasing for 2023. Choose either box 1 or box 2: Use a a4 form 2021 template to make your document workflow.

A4 form Fill out & sign online DocHub

Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. The arizona department of revenue has. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Use a a4 form 2021 template to make.

A4_201602_sp Form Fillable Pdf Template Download Here!

Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. Web this form is for income earned in tax year 2021, with tax returns due in april 2022. Form year form published ; The tax rates used on arizona’s withholding certificates are decreasing for 2023. The arizona department of revenue has.

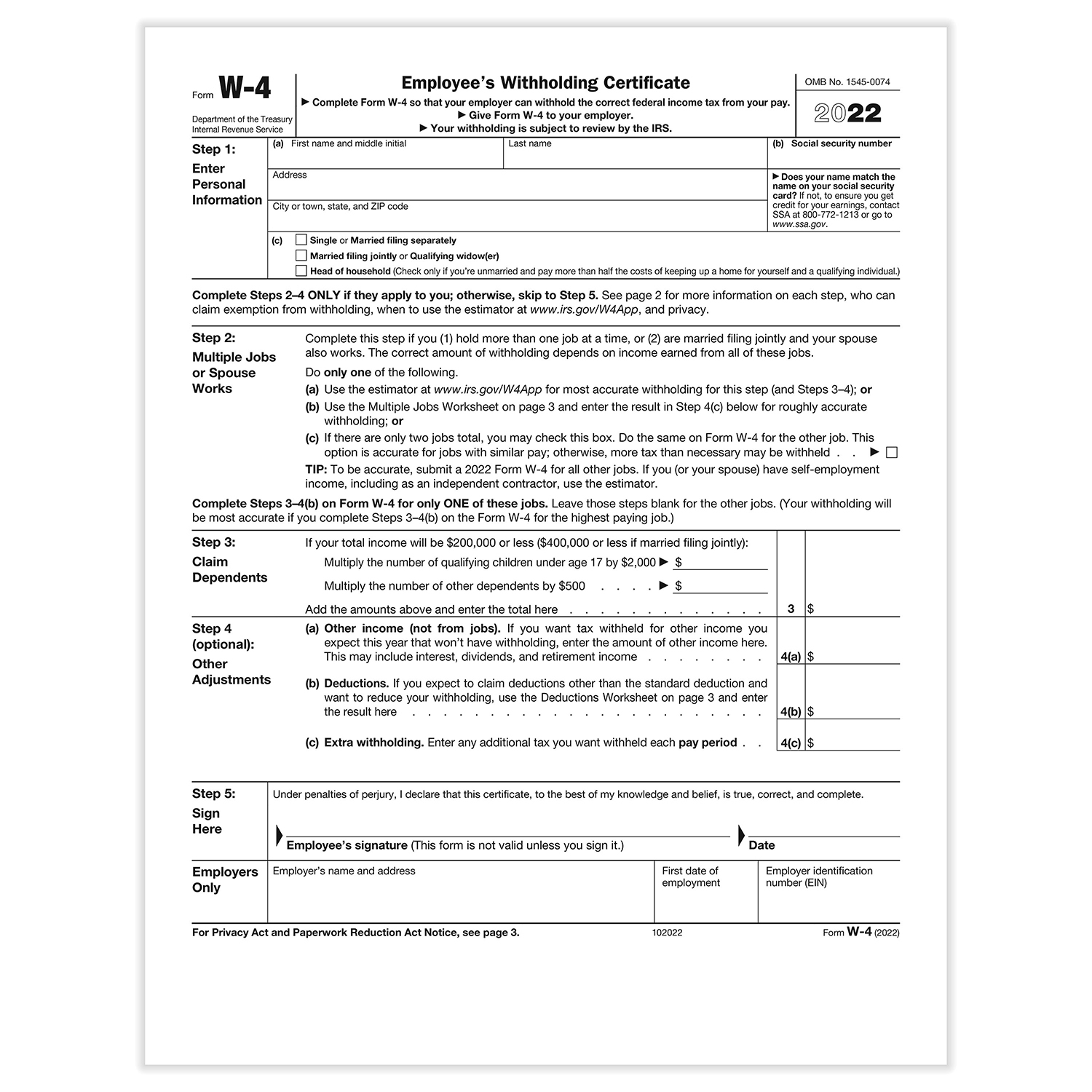

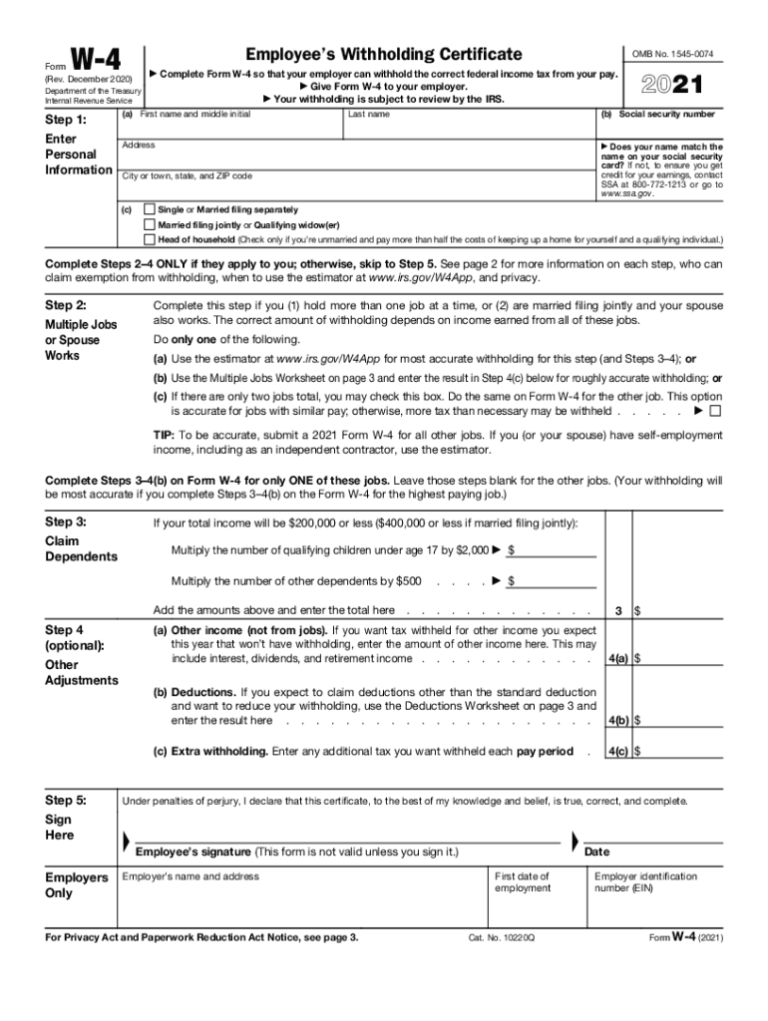

2023 IRS W 4 Form HRdirect Fillable Form 2023

Web this form is for income earned in tax year 2021, with tax returns due in april 2022. Use a a4 form 2021 template to make your document workflow. You can use your results. As a result, we are revising. File this form to change the arizona withholding percentage or to change the extra amount withheld.

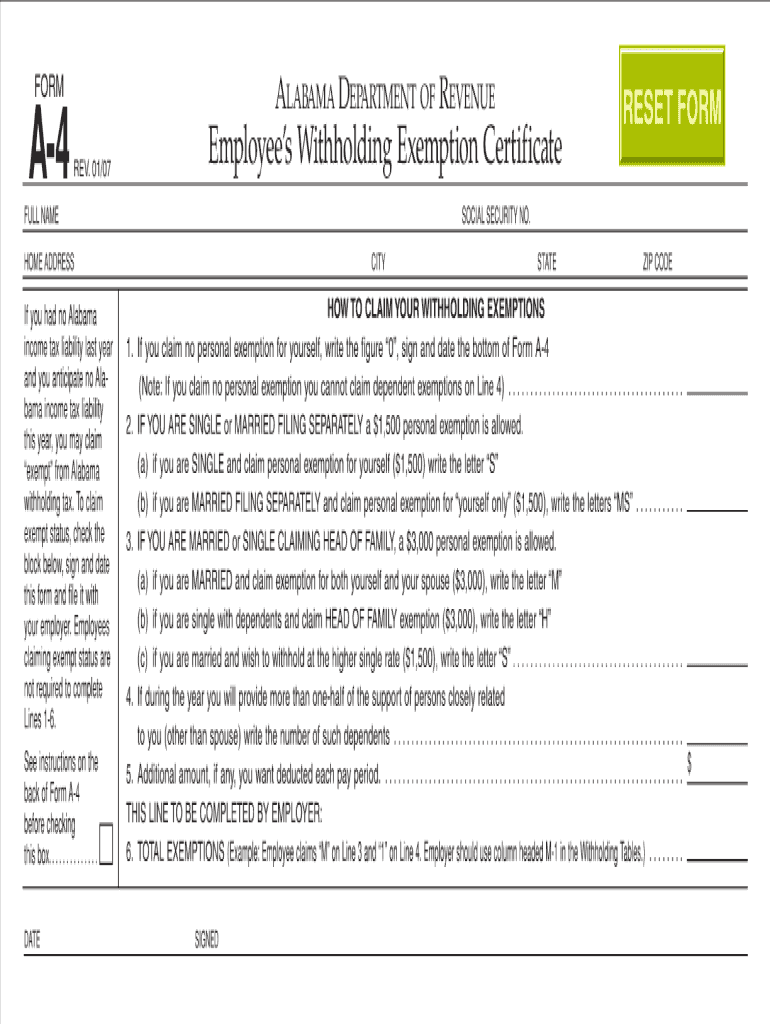

2007 Form AL DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

Web this form is for income earned in tax year 2021, with tax returns due in april 2022. The tax rates used on arizona’s withholding certificates are decreasing for 2023. Form year form published ; Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. You can use your results.

Download Arizona Form A4 (2013) for Free FormTemplate

Web thursday, december 15, 2022. 1 withhold from gross taxable. You can use your results. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Form year form published ;

Printable A4 Form 2023 Fillable Form 2023 941 Tax IMAGESEE

You can use your results. The arizona department of revenue has. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Choose either box 1 or box 2: File this form to change the arizona withholding percentage or to change the extra amount.

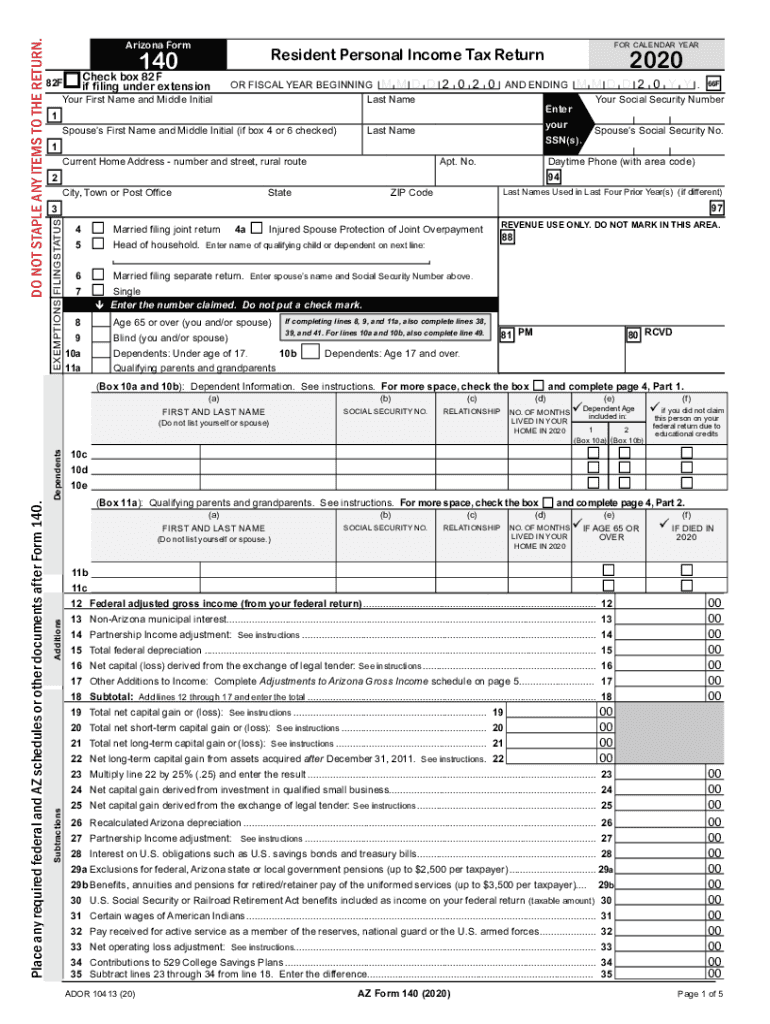

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Use a a4 form 2021 template to make your document workflow. The arizona department of revenue (dor). Web 20 rows withholding forms. Form year form published ; Web this form is for income earned in tax year 2021, with tax returns due in april 2022.

1 Withhold From Gross Taxable.

File this form to change the arizona withholding percentage or to change the extra amount withheld. The arizona department of revenue has. Use a a4 form 2021 template to make your document workflow. Web this form is for income earned in tax year 2021, with tax returns due in april 2022.

Form Year Form Published ;

Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web thursday, december 15, 2022. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. The arizona department of revenue (dor).

Web 2 I Elect An Arizona Withholding Percentage Of Zero, And I Certify That I Expect To Have No Arizona Tax Liability For The Current Taxable Year.

You can use your results. Web 20 rows withholding forms. The tax rates used on arizona’s withholding certificates are decreasing for 2023. As a result, we are revising.

Choose Either Box 1 Or Box 2:

Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department.