Form 5329 Pdf

Form 5329 Pdf - Name of person authorized to direct disposition of remains 8. You may need this form in three situations: When and where to file. Reasons for excess ira contributions expand all collapse all income limits annual contribution limit ineligible rollover what are my options if i have an excess contribution? Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Mortuary affairs officer (official mailing address) 3. Go to www.irs.gov/form5329 for instructions and the latest information. Want more help with form 5329? Condition of remains upon arrival at funeral. Web form 5329 (2022) page.

Web da form 5329, jul 2021. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Condition of remains upon arrival at funeral. Go to www.irs.gov/form5329 for instructions and the latest information. If you’re looking for more help with tax reporting using form 5329, get the help of h&r block. Reasons for excess ira contributions expand all collapse all income limits annual contribution limit ineligible rollover what are my options if i have an excess contribution? Also, use this code if more than one exception applies. You may need this form in three situations: Want more help with form 5329? Complete this part if the contributions to your coverdell esas for 2022 were more than is allowable or you had an amount on line 33 of your 2021 form 5329.

Name of deceased (last, first, middle) 6. Want more help with form 5329? Complete this part if the contributions to your coverdell esas for 2022 were more than is allowable or you had an amount on line 33 of your 2021 form 5329. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. If you’re looking for more help with tax reporting using form 5329, get the help of h&r block. Also, use this code if more than one exception applies. To view form 5329 instructions, visit irs.gov. Enter the excess contributions from line 32 of your 2021 form 5329. Web form 5329 (2022) page. 2 part v additional tax on excess contributions to coverdell esas.

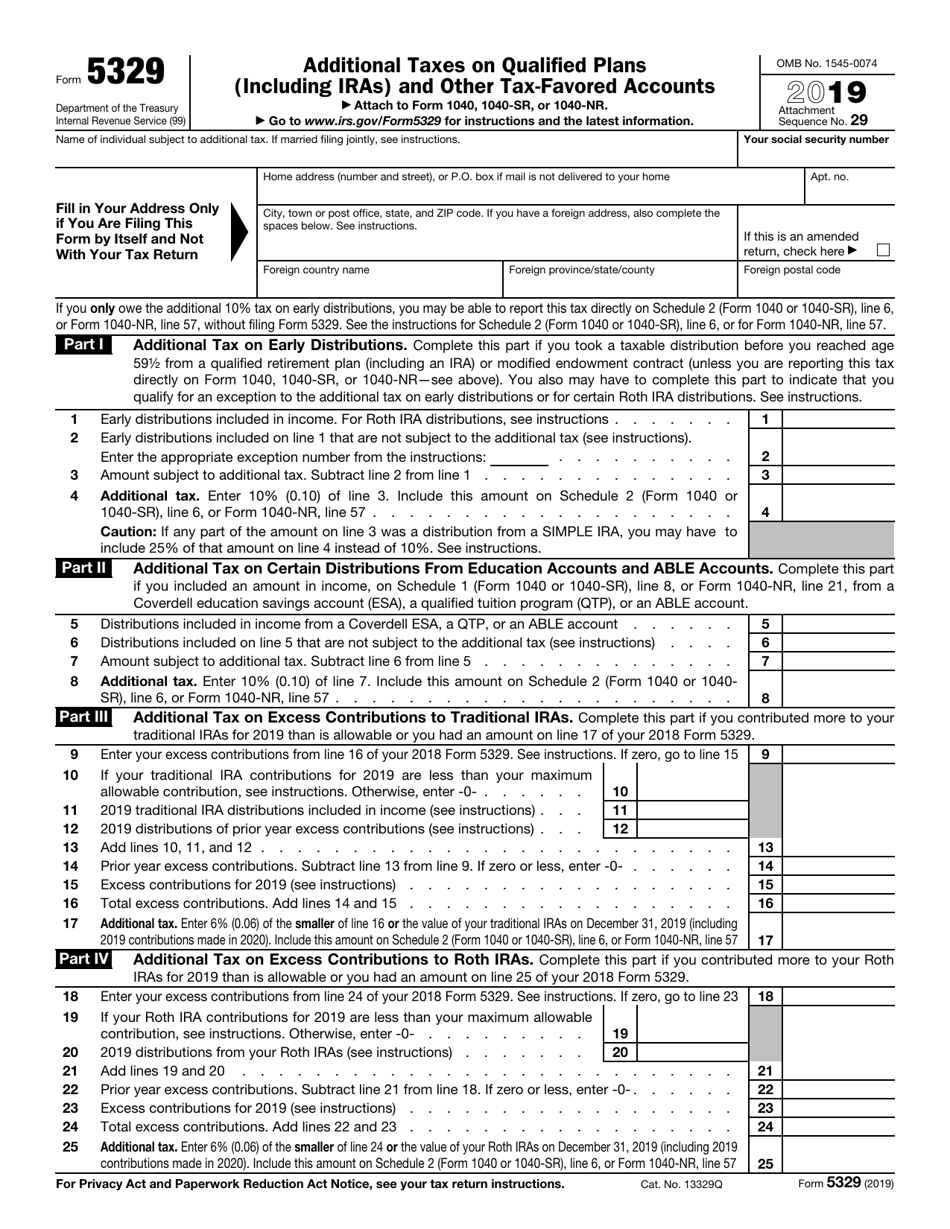

IRS Form 5329 Download Fillable PDF or Fill Online Additional Taxes on

2 part v additional tax on excess contributions to coverdell esas. Want more help with form 5329? If you don’t have to file a 2022 income tax return, complete Web da form 5329, jul 2021. Mortuary affairs officer (official mailing address) 3.

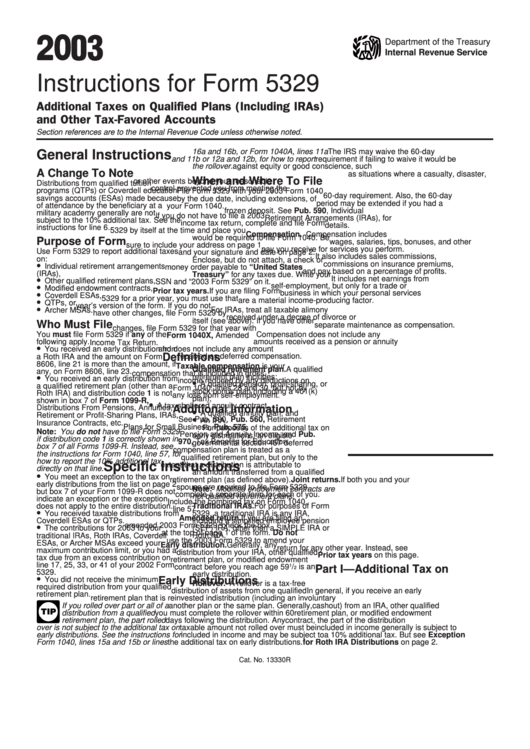

Instructions for How to Fill in IRS Form 5329

Web da form 5329, jul 2021. Name and address of receiving funeral home (include zip code) 10. To view form 5329 instructions, visit irs.gov. You may need this form in three situations: 2 part v additional tax on excess contributions to coverdell esas.

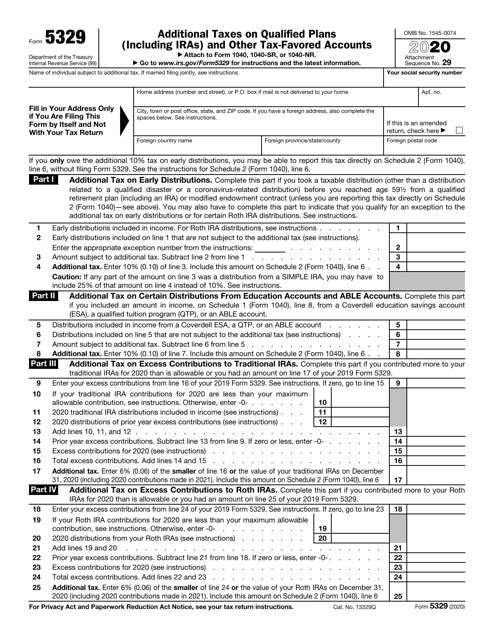

Form 5329 Edit, Fill, Sign Online Handypdf

2 part v additional tax on excess contributions to coverdell esas. If you’re looking for more help with tax reporting using form 5329, get the help of h&r block. Condition of remains upon arrival at funeral. Mortuary affairs officer (official mailing address) 3. Web 12 — other — see form 5329 instructions.

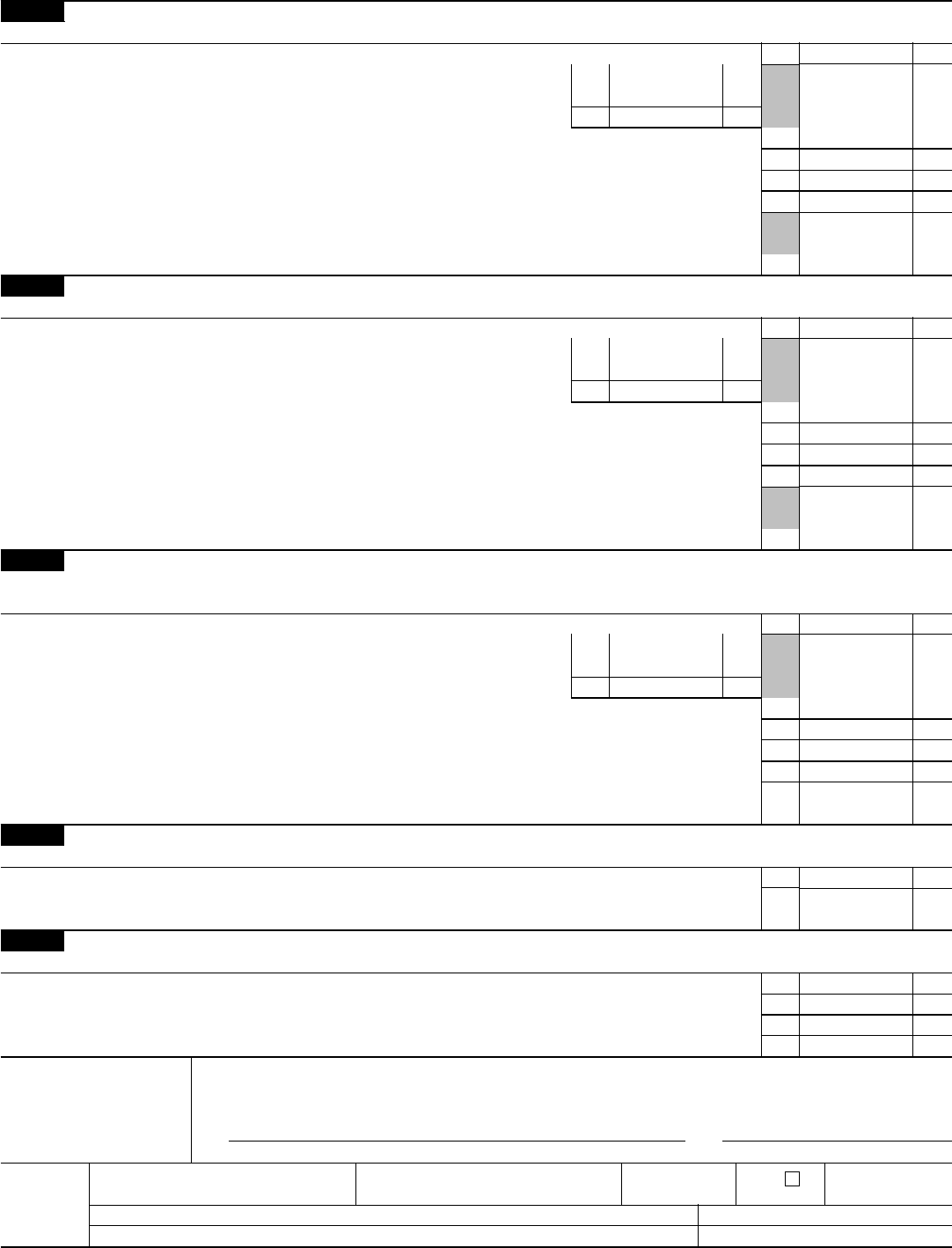

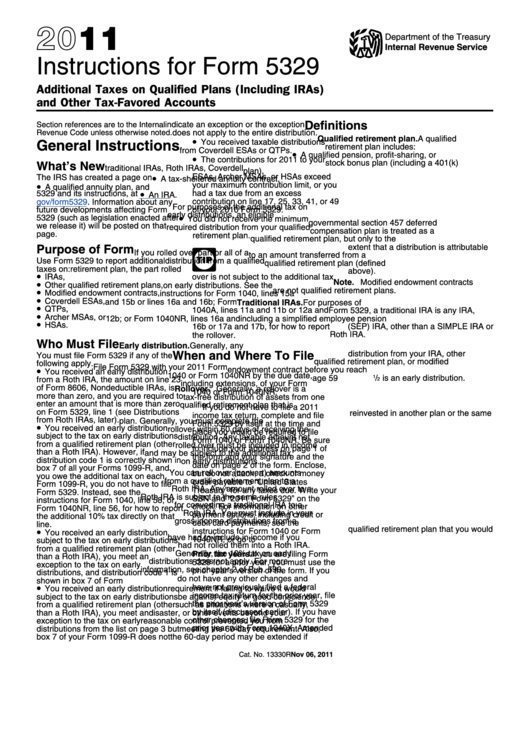

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Name of deceased (last, first, middle) 6. Web form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. To view form 5329 instructions, visit irs.gov. Reasons for excess ira contributions expand all collapse all income limits annual contribution limit ineligible rollover what are my options if.

IRS Form 5329 Download Fillable PDF or Fill Online Additional Taxes on

Web form 5329 (2022) page. Web 12 — other — see form 5329 instructions. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete.

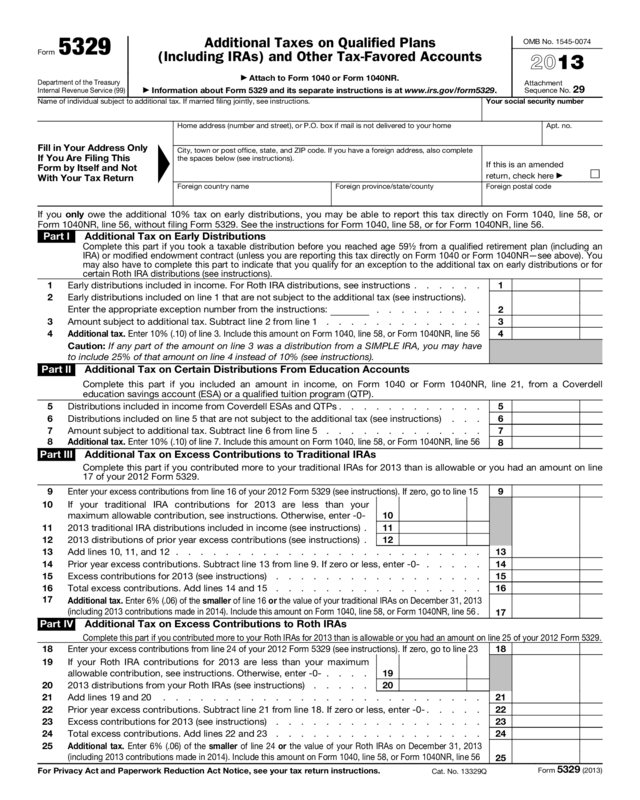

2013 Form 5329 Edit, Fill, Sign Online Handypdf

Name of person authorized to direct disposition of remains 8. Web form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Name and address of receiving funeral home (include zip code) 10. Web da form 5329, jul 2021. Condition of remains upon arrival at funeral.

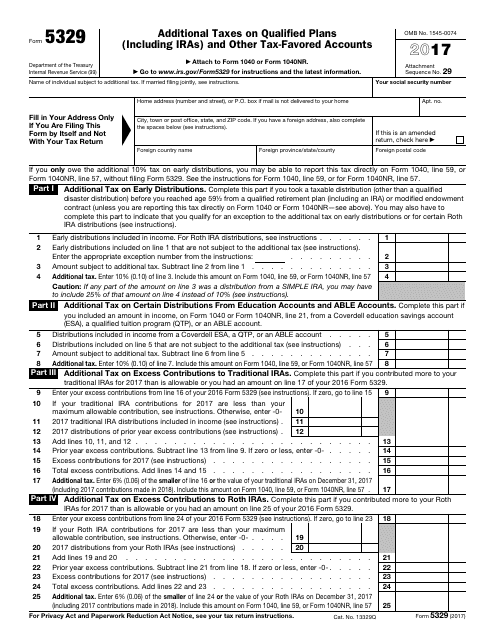

IRS Form 5329 Download Fillable PDF 2017, Additional Taxes on Qualified

Complete this part if the contributions to your coverdell esas for 2022 were more than is allowable or you had an amount on line 33 of your 2021 form 5329. Name of deceased (last, first, middle) 6. Web da form 5329, jul 2021. You may need this form in three situations: Go to www.irs.gov/form5329 for instructions and the latest information.

Form 5329 Instructions & Exception Information for IRS Form 5329

You may need this form in three situations: Name of person authorized to direct disposition of remains 8. If you’re looking for more help with tax reporting using form 5329, get the help of h&r block. Mortuary affairs officer (official mailing address) 3. Name of deceased (last, first, middle) 6.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Name of person authorized to direct disposition of remains 8. Condition of remains upon arrival at funeral. Complete this part if the contributions to your coverdell esas for 2022 were more than is allowable or you had an amount on line 33 of your 2021 form 5329. Want more help with form 5329? Web use form 5329 to report additional.

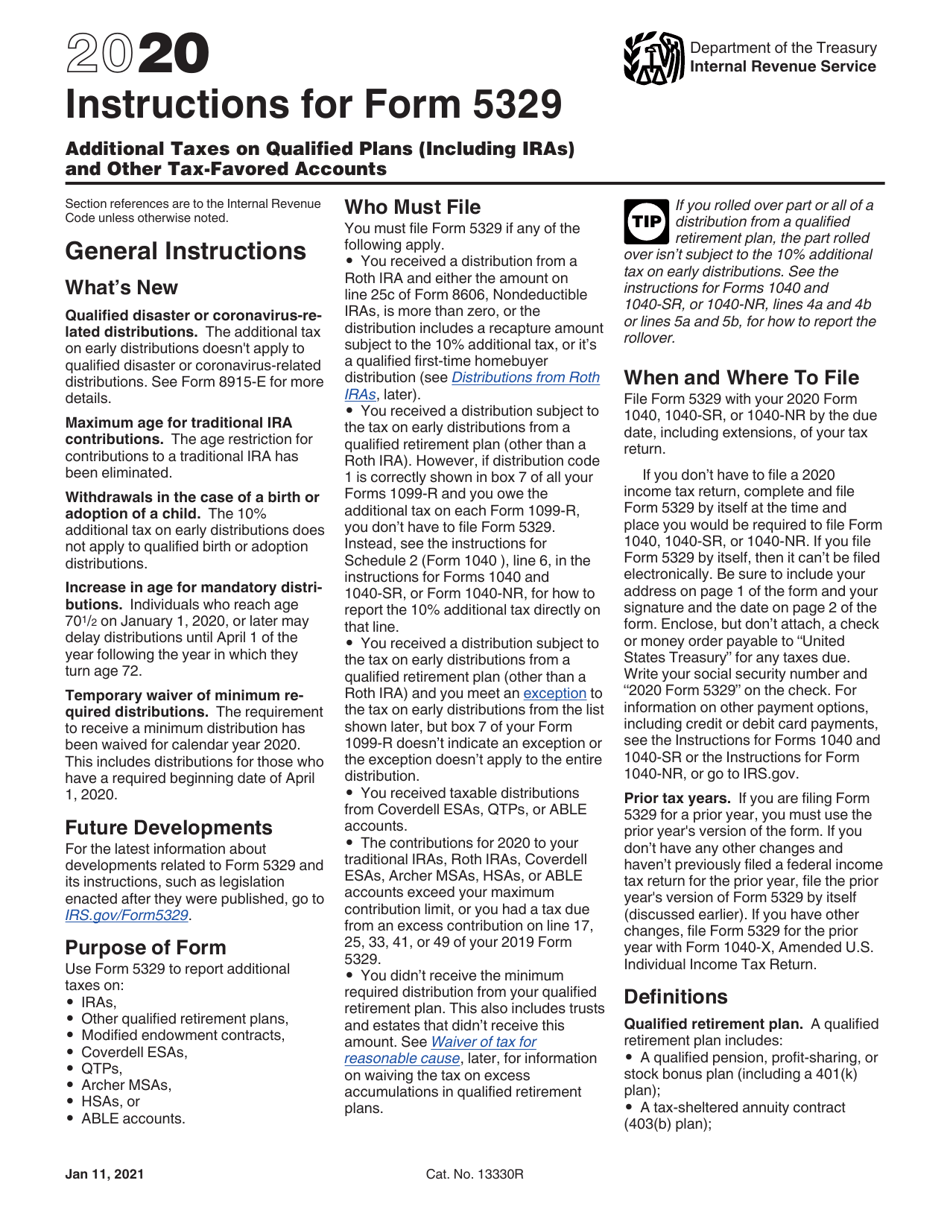

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

Also, use this code if more than one exception applies. Web form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. You may need this form in three situations: Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts,.

Complete This Part If The Contributions To Your Coverdell Esas For 2022 Were More Than Is Allowable Or You Had An Amount On Line 33 Of Your 2021 Form 5329.

When and where to file. Condition of remains upon arrival at funeral. Also, use this code if more than one exception applies. Go to www.irs.gov/form5329 for instructions and the latest information.

Web Da Form 5329, Jul 2021.

Enter the excess contributions from line 32 of your 2021 form 5329. You may need this form in three situations: Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Name of deceased (last, first, middle) 6.

Web 12 — Other — See Form 5329 Instructions.

Name and address of receiving funeral home (include zip code) 10. If you don’t have to file a 2022 income tax return, complete 2 part v additional tax on excess contributions to coverdell esas. Web form 5329 (2022) page.

Name Of Person Authorized To Direct Disposition Of Remains 8.

To view form 5329 instructions, visit irs.gov. Mortuary affairs officer (official mailing address) 3. Web form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. If you’re looking for more help with tax reporting using form 5329, get the help of h&r block.