Form 8863 Instructions 2021

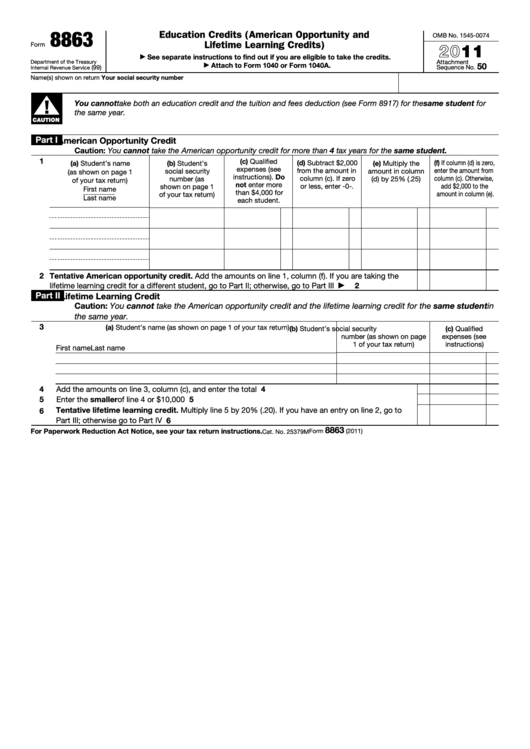

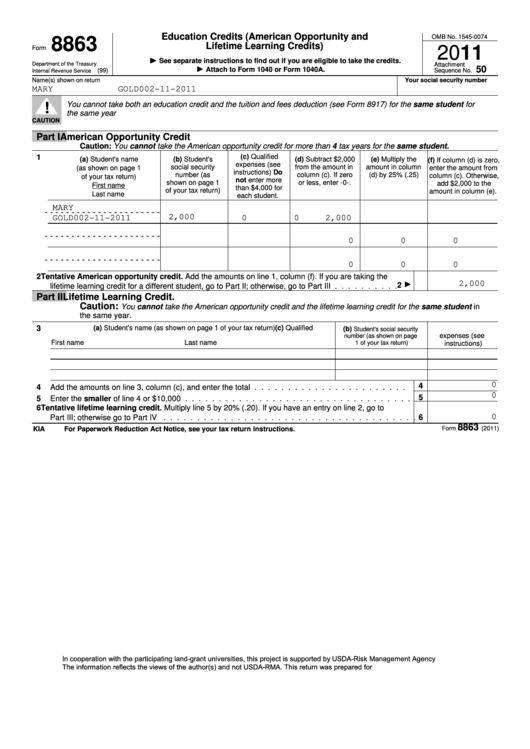

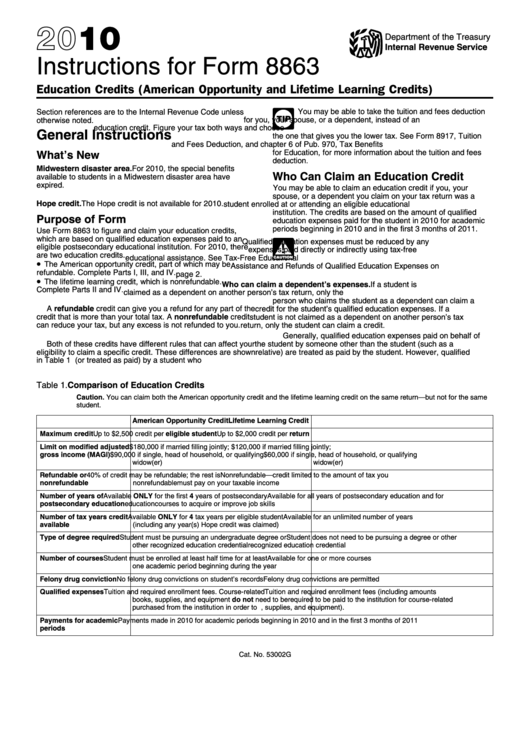

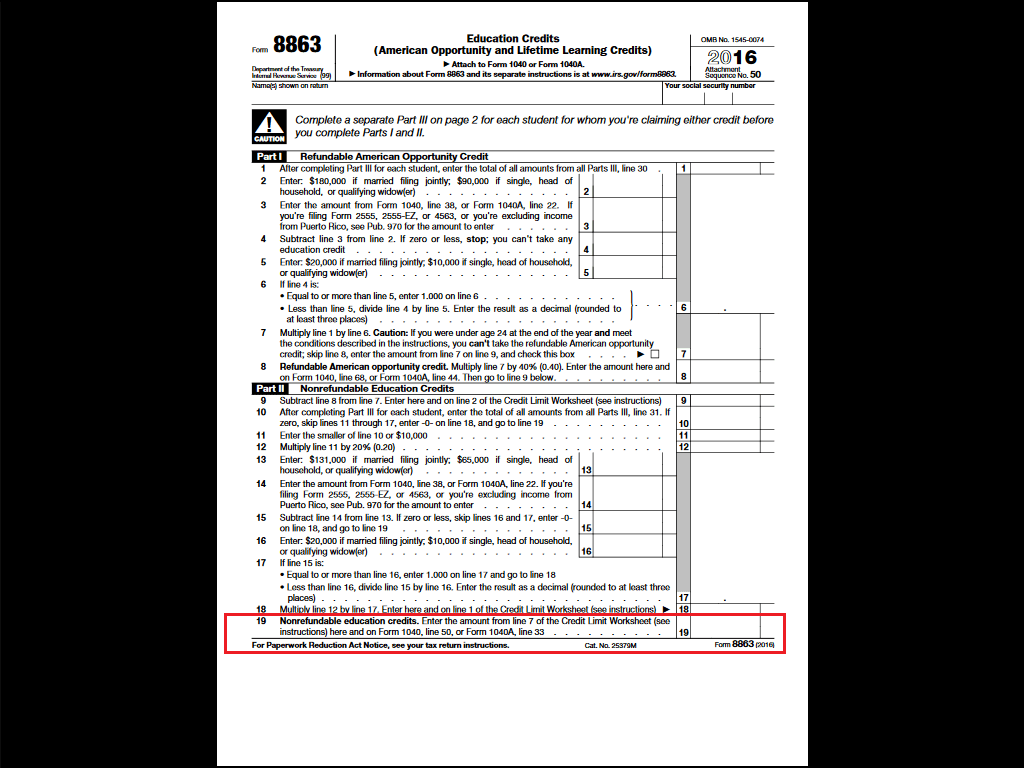

Form 8863 Instructions 2021 - The american opportunity credit (aoc), part of which may be refundable, and the lifetime learning credit (llc), which is not refundable. Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families. What's new limits on modified adjusted gross income (magi). In this article, we’ll explore irs form 8863, education credits. Web how to calculate magi eligible educational institution defined which expenses aren’t covered by aotc and llc? Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Find out more about what education expenses qualify. The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits

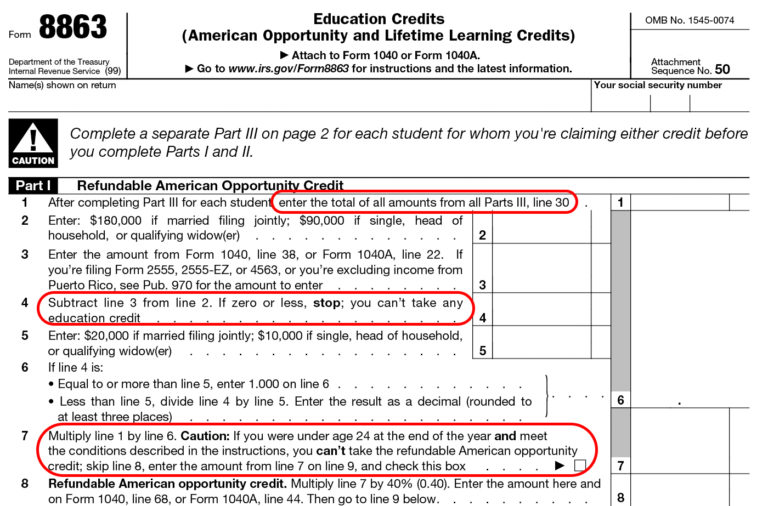

Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families. The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Find out more about what education expenses qualify. The american opportunity credit (aoc), part of which may be refundable, and the lifetime learning credit (llc), which is not refundable. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Go to www.irs.gov/form8863 for instructions and the latest information. Irs form 8863 instructions tips for irs form 8863 what is form 8863? Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers).

What's new limits on modified adjusted gross income (magi). The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Find out more about what education expenses qualify. Go to www.irs.gov/form8863 for instructions and the latest information. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Irs form 8863 instructions tips for irs form 8863 what is form 8863? The education credits are designed to offset updated for current information. Go to www.irs.gov/form8863 for instructions and the latest information. Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. The lifetime learning credit magi limit increases to $180,000 if you're

Fillable Form 8863 Education Credits (American Opportunity And

In this article, we’ll explore irs form 8863, education credits. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to.

IRS Update for Form 8863 Education Tax Credits The TurboTax Blog

The lifetime learning credit magi limit increases to $180,000 if you're Go to www.irs.gov/form8863 for instructions and the latest information. The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Go to www.irs.gov/form8863 for instructions and the latest information. The american opportunity credit (aoc), part of which may be refundable, and.

Sample Form 8863 Education Credits (American Opportunity And Lifetime

The american opportunity credit (aoc), part of which may be refundable, and the lifetime learning credit (llc), which is not refundable. The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits The education credits are designed to offset updated for current information. Web step by step instructions comments in the united.

Instructions For Form 8863 Education Credits (American Opportunity

Go to www.irs.gov/form8863 for instructions and the latest information. Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers). The lifetime learning.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

Find out more about what education expenses qualify. What's new limits on modified adjusted gross income (magi). The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Go to www.irs.gov/form8863 for instructions and the latest information. Web how to calculate magi eligible educational institution defined which expenses aren’t covered by aotc.

Form 8863 Instructions & Information on the Education Credit Form

The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Go to www.irs.gov/form8863 for instructions and the latest information. Web for the latest information about developments related to form 8863 and its.

Form 8863 Instructions Information On The Education 1040 Form Printable

Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families. The lifetime learning credit magi limit increases to $180,000 if you're 50 name(s) shown on return Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were.

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers). Web how to calculate magi eligible educational institution defined which expenses aren’t.

MW My 2004 Federal and State Tax Returns

Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers). Web step by step instructions comments in the united states, education credits.

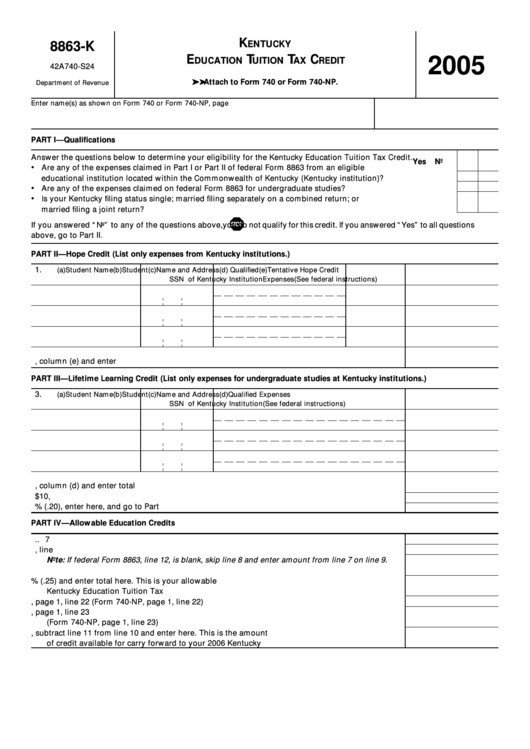

Fillable Form 8863K Education Tuition Tax Credit 2005 printable pdf

Irs form 8863 instructions tips for irs form 8863 what is form 8863? Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. What's new limits on modified adjusted gross income (magi). Web how to calculate magi eligible educational institution defined which expenses aren’t covered.

The Education Credits Are Designed To Offset Updated For Current Information.

What's new limits on modified adjusted gross income (magi). Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). 50 name(s) shown on return Web how to calculate magi eligible educational institution defined which expenses aren’t covered by aotc and llc?

Find Out More About What Education Expenses Qualify.

In this article, we’ll explore irs form 8863, education credits. Irs form 8863 instructions tips for irs form 8863 what is form 8863? Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return.

The Lifetime Learning Credit Magi Limit Increases To $180,000 If You're

Web llc, you (or your dependent) must be (or have been) a student who is (or was) enrolled in at least one course during the tax year, and have a modified adjusted gross income below the threshold (for 2020, the threshold is $69,000 or $139,000 for joint filers). Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. Go to www.irs.gov/form8863 for instructions and the latest information. Go to www.irs.gov/form8863 for instructions and the latest information.

Web Step By Step Instructions Comments In The United States, Education Credits Can Be One Of The Biggest Tax Benefits For Many Families.

The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits The american opportunity credit (aoc), part of which may be refundable, and the lifetime learning credit (llc), which is not refundable.