Form 990 Ez Schedule B

Form 990 Ez Schedule B - If “no,” explain in part v. $ part i revenue, expenses, and changes in net assets or fund balances (see the instructions for part i) check if the organization used schedule o to respond to any question in this part i. All supporting organizations (complete only if you checked a box in line 12 on part i. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Go to www.irs.gov/form990 for the latest information. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Also, provide any other additional information. Part v supplemental information provide the explanation required by part iv, line 6b. Complete columns (a) through (e) and

If the organization answered “yes” to form 990, line h(a), but “no” to line h(b), use a separate attachment to list the name, address, and Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. All supporting organizations (complete only if you checked a box in line 12 on part i. Go to www.irs.gov/form990 for the latest information. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to determine gross receipts. If “no,” explain in part v. $ part i revenue, expenses, and changes in net assets or fund balances (see the instructions for part i) check if the organization used schedule o to respond to any question in this part i. Complete columns (a) through (e) and Part v supplemental information provide the explanation required by part iv, line 6b.

Part v supplemental information provide the explanation required by part iv, line 6b. Complete columns (a) through (e) and If the organization answered “yes” to form 990, line h(a), but “no” to line h(b), use a separate attachment to list the name, address, and If “no,” explain in part v. Also, provide any other additional information. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Corporation trust association other add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Go to www.irs.gov/form990 for the latest information. All supporting organizations (complete only if you checked a box in line 12 on part i.

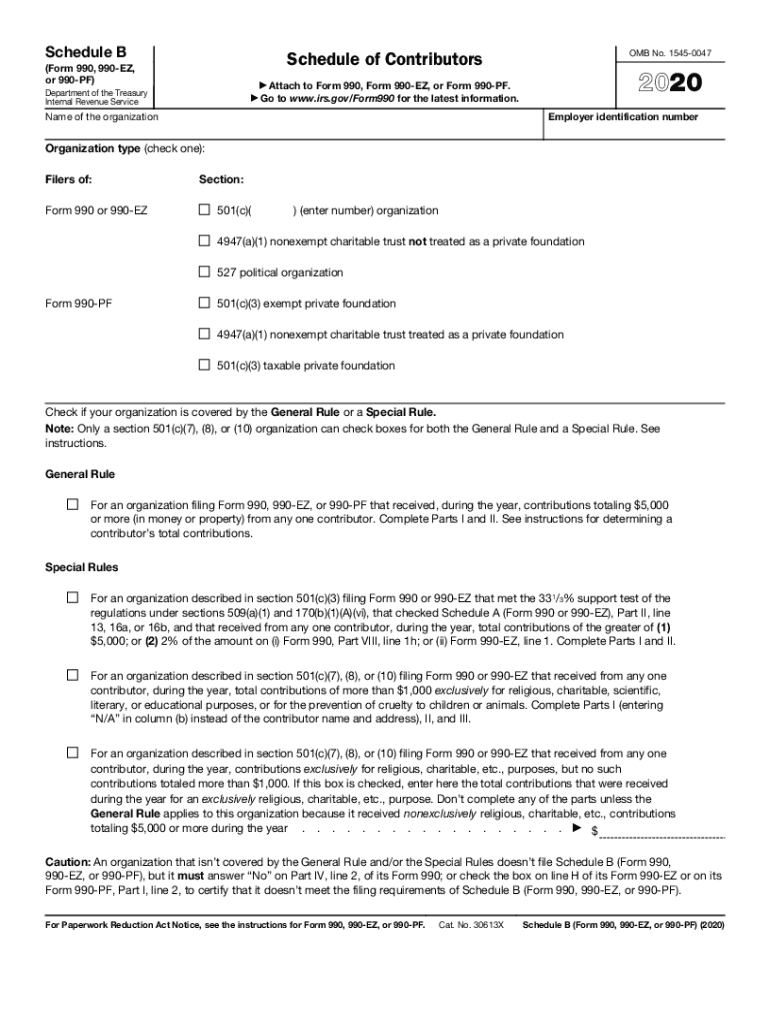

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

All supporting organizations (complete only if you checked a box in line 12 on part i. Complete columns (a) through (e) and If “no,” explain in part v. Also, provide any other additional information. If the organization answered “yes” to form 990, line h(a), but “no” to line h(b), use a separate attachment to list the name, address, and

2020 Form IRS 990 Schedule B Fill Online, Printable, Fillable, Blank

Go to www.irs.gov/form990 for the latest information. If the organization answered “yes” to form 990, line h(a), but “no” to line h(b), use a separate attachment to list the name, address, and If “no,” explain in part v. $ part i revenue, expenses, and changes in net assets or fund balances (see the instructions for part i) check if the.

2020 Form IRS 990 or 990EZ Schedule N Fill Online, Printable

If the organization answered “yes” to form 990, line h(a), but “no” to line h(b), use a separate attachment to list the name, address, and Go to www.irs.gov/form990 for the latest information. Also, provide any other additional information. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; If “no,” explain in part v.

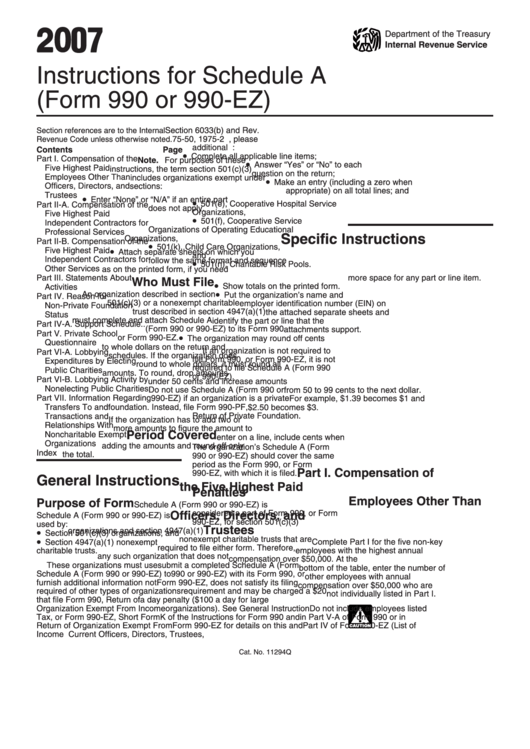

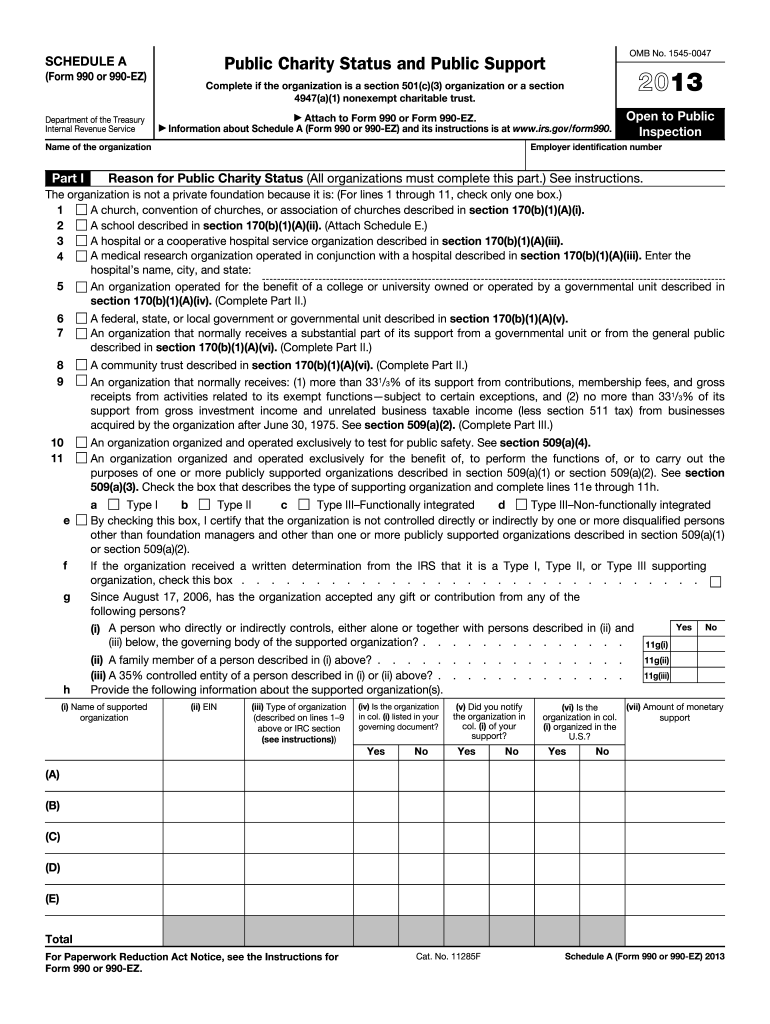

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

Complete columns (a) through (e) and Also, provide any other additional information. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; If “no,” explain in part v.

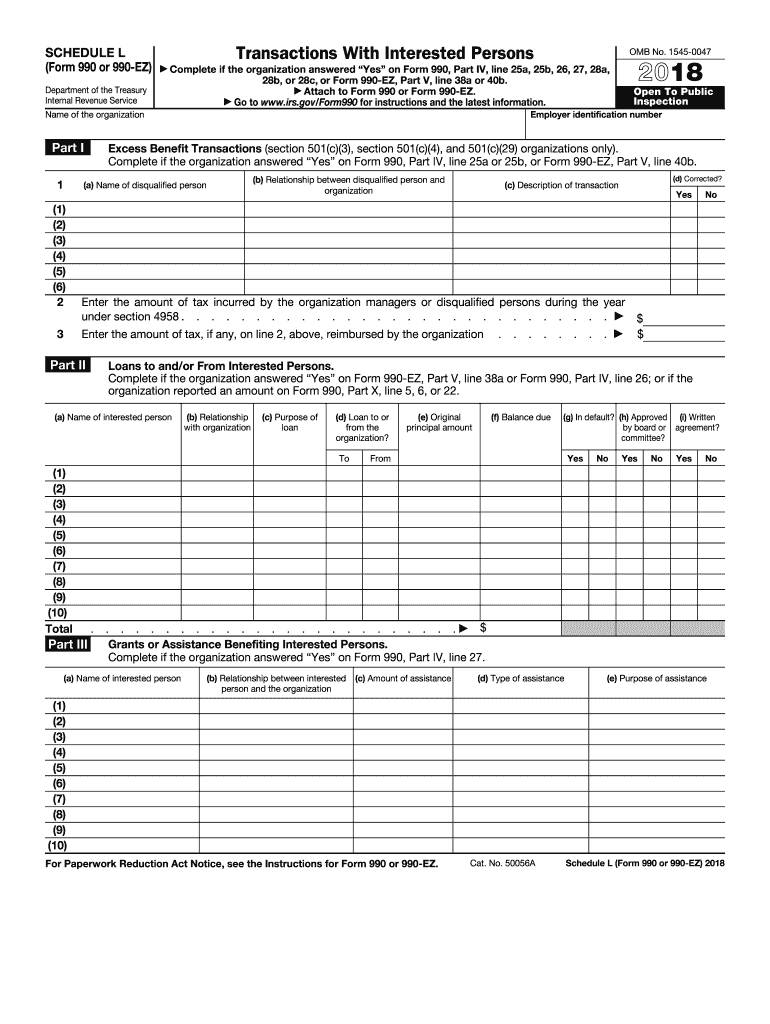

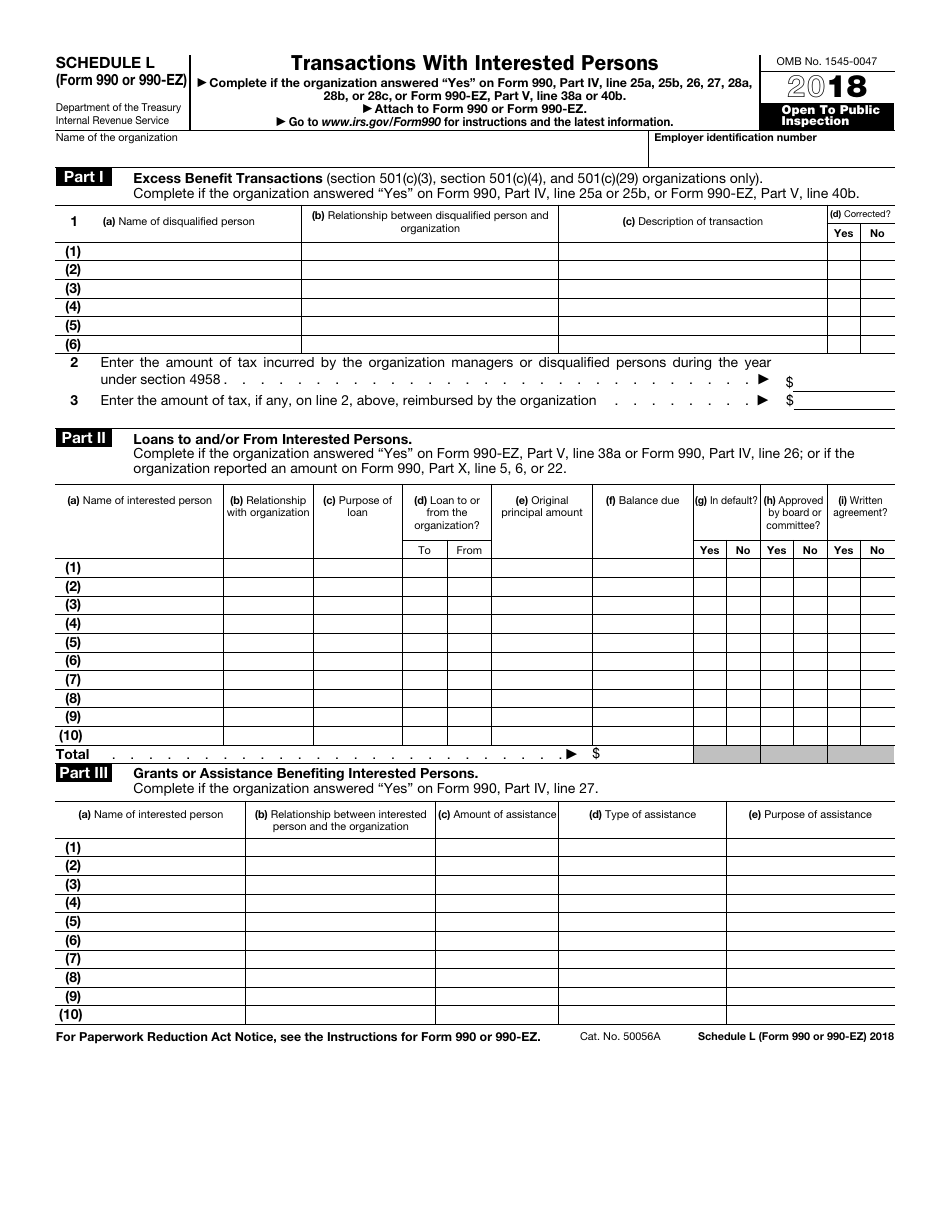

IRS 990 or 990EZ Schedule L 2018 Fill out Tax Template Online US

Part v supplemental information provide the explanation required by part iv, line 6b. Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Go to www.irs.gov/form990 for the latest information. Corporation trust association other add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Also, provide any other additional information.

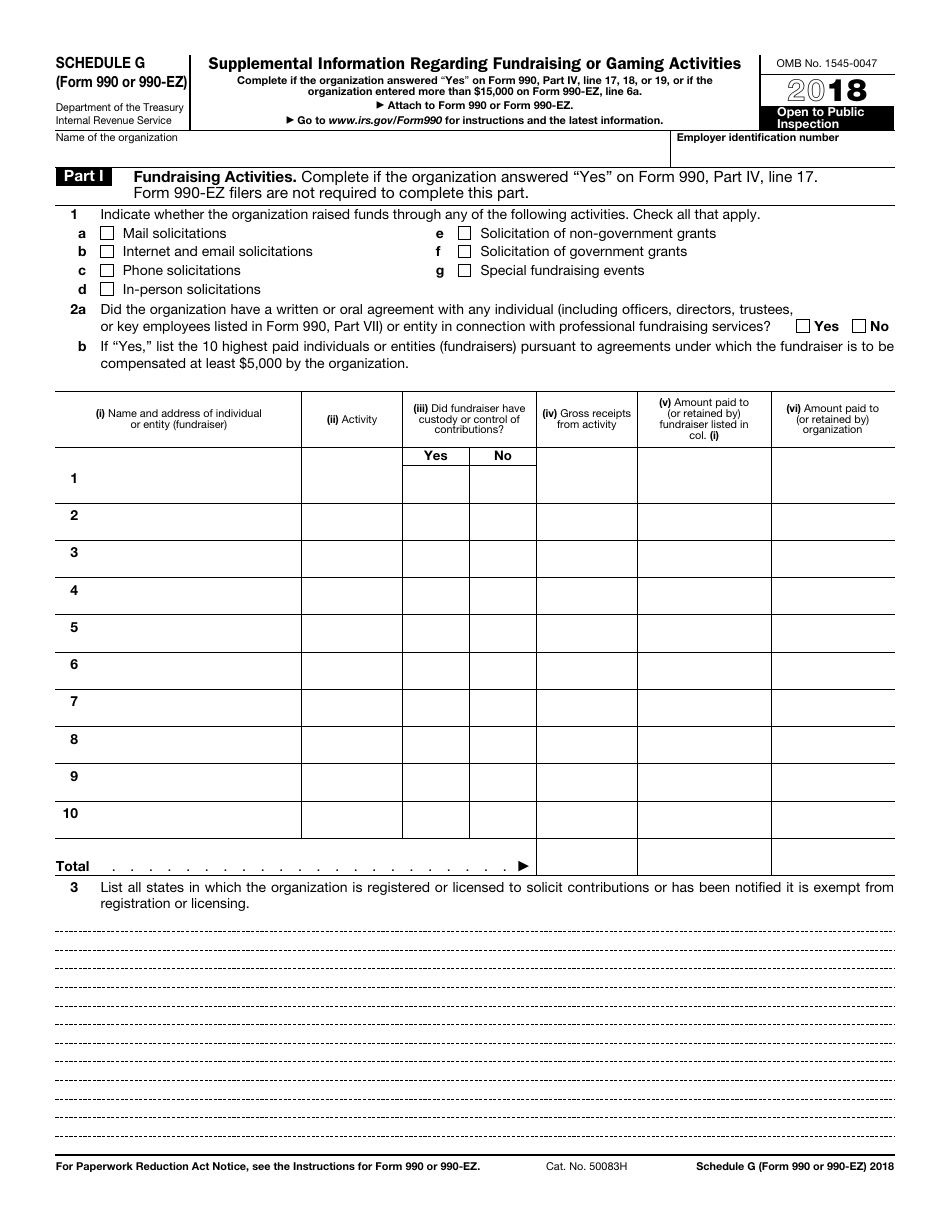

IRS Form 990 (990EZ) Schedule G Download Fillable PDF or Fill Online

All supporting organizations (complete only if you checked a box in line 12 on part i. Also, provide any other additional information. Complete columns (a) through (e) and If the organization answered “yes” to form 990, line h(a), but “no” to line h(b), use a separate attachment to list the name, address, and Form 990, return of organization exempt from.

Schedule B (Form 990, 990 EZ) Grants Equivalent to Contributions

Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. All supporting organizations (complete only if you checked a box in line 12 on part i. Complete columns (a) through (e) and Part.

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Form 990, return of organization exempt from income tax, part viii, statement of revenue, line 1; Go to www.irs.gov/form990 for the latest information. Complete columns (a) through (e) and If the organization answered “yes” to form 990, line h(a), but “no” to line h(b), use a separate attachment to list the name, address, and Web schedule b is used by.

Schedule H 990 Online PDF Template

Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. Go to www.irs.gov/form990 for the latest information. $ part i revenue, expenses, and changes in net assets or fund balances (see the instructions for part i) check if the organization used schedule o to respond to any question in.

990 Ez Form Fill Out and Sign Printable PDF Template signNow

All supporting organizations (complete only if you checked a box in line 12 on part i. Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. If the organization answered “yes” to form 990, line h(a), but “no” to line h(b), use a separate attachment to list the name,.

Corporation Trust Association Other Add Lines 5B, 6C, And 7B To Line 9 To Determine Gross Receipts.

If the organization answered “yes” to form 990, line h(a), but “no” to line h(b), use a separate attachment to list the name, address, and $ part i revenue, expenses, and changes in net assets or fund balances (see the instructions for part i) check if the organization used schedule o to respond to any question in this part i. Part v supplemental information provide the explanation required by part iv, line 6b. Complete columns (a) through (e) and

Form 990, Return Of Organization Exempt From Income Tax, Part Viii, Statement Of Revenue, Line 1;

Web schedule b is used by nonprofit organizations to report details regarding the contributions they received during the corresponding tax year. All supporting organizations (complete only if you checked a box in line 12 on part i. If “no,” explain in part v. Also, provide any other additional information.