How Do I Fill Out Form 5695 For Solar Panels

How Do I Fill Out Form 5695 For Solar Panels - Web what you need before filing there are just a few items you need before filing for you solar tax credit. In the search bar, type 5695. It’s easy to fill out and you don’t need a tax professional to do it. A insulation material or system specifically and primarily designed to reduce. Web for qualified fuel cell property, see lines 7a and 7b, later. Web reasonably be expected to last for at least 5 years; In the topic box, highlight 5695, residential energy credit, then click go. Web this form is used to add refundable credits to your schedule 3 or form 1040. For instructions and the latest information. Department of the treasury internal revenue service.

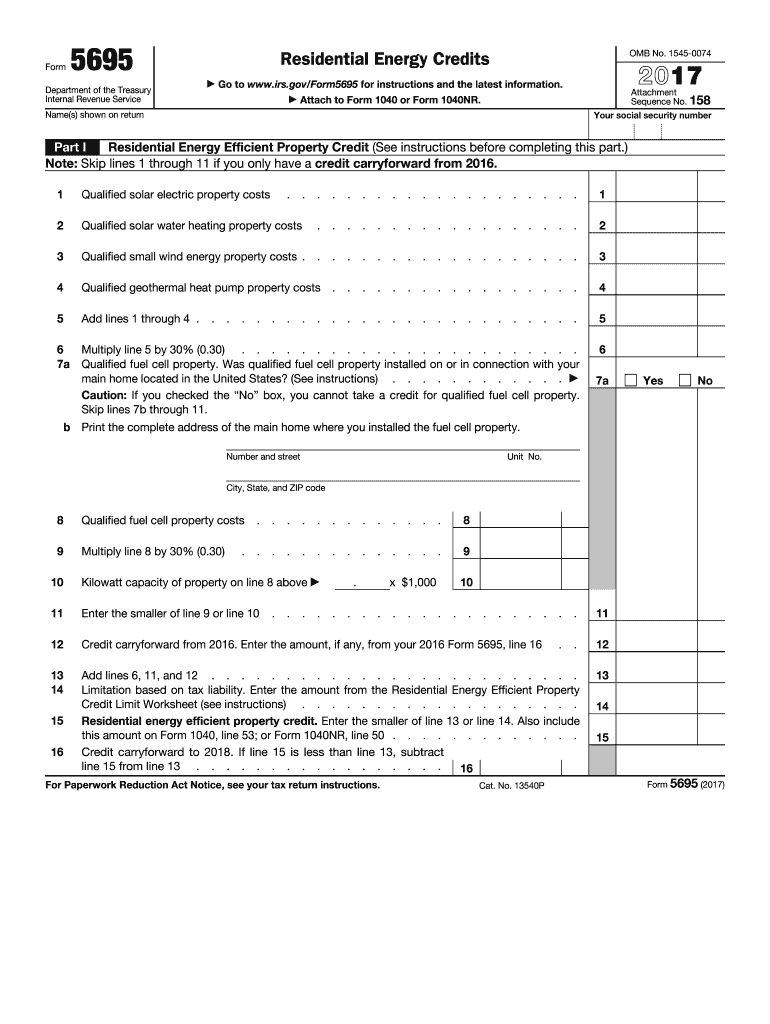

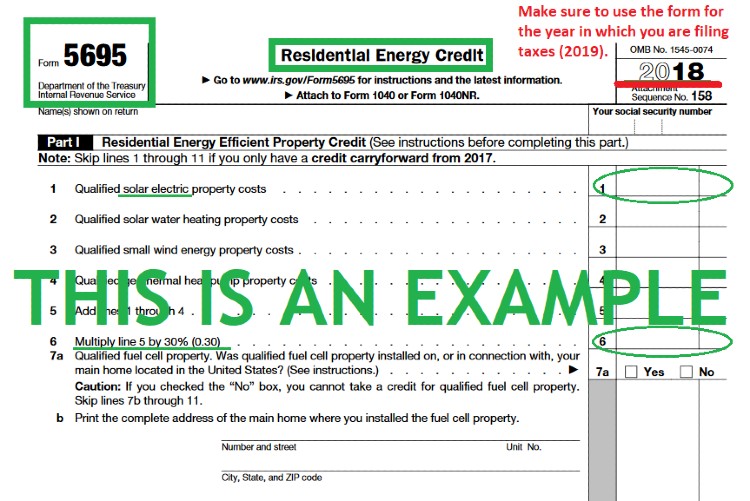

Web this form is used to add refundable credits to your schedule 3 or form 1040. The residential energy credits are: Receipts from your solar panels. The residential clean energy credit, and the energy efficient home. Web irs form 5695 is needed in your federal tax filings to calculate the number of tax credits you can gain from your qualified home energy improvements. Web what you need to claim the tax credit the receipts from your solar installation irs form 1040 for 2022 irs form 5695 for 2022 instructions for both those forms (also. Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. In the topic box, highlight 5695, residential energy credit, then click go. In the search bar, type 5695. Web for qualified fuel cell property, see lines 7a and 7b, later.

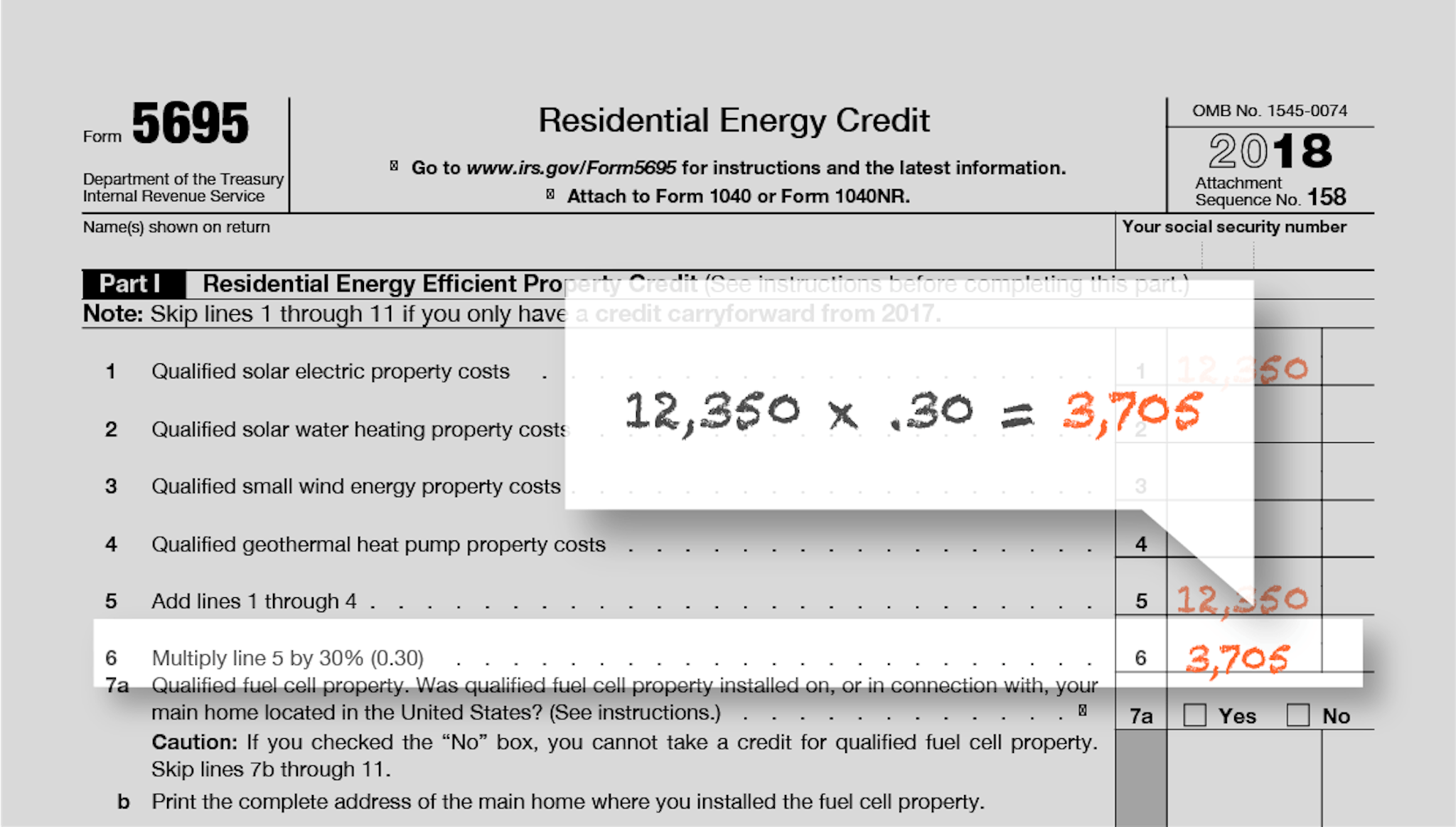

In the search bar, type 5695. Receipts from your solar panels. Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Web use form 5695 to figure and take your residential energy credits. In the search bar, type 5695. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property,. Web for qualified fuel cell property, see lines 7a and 7b, later. Current revision form 5695 pdf instructions for form 5695 ( print. Department of the treasury internal revenue service. For updates on the 2022 versions of form 5695, see the following playlist:

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Web what you need to claim the tax credit the receipts from your solar installation irs form 1040 for 2022 irs form 5695 for 2022 instructions for both those forms (also. Do not include labor costs) (see instructions). Receipts from your solar panels. Web catch.

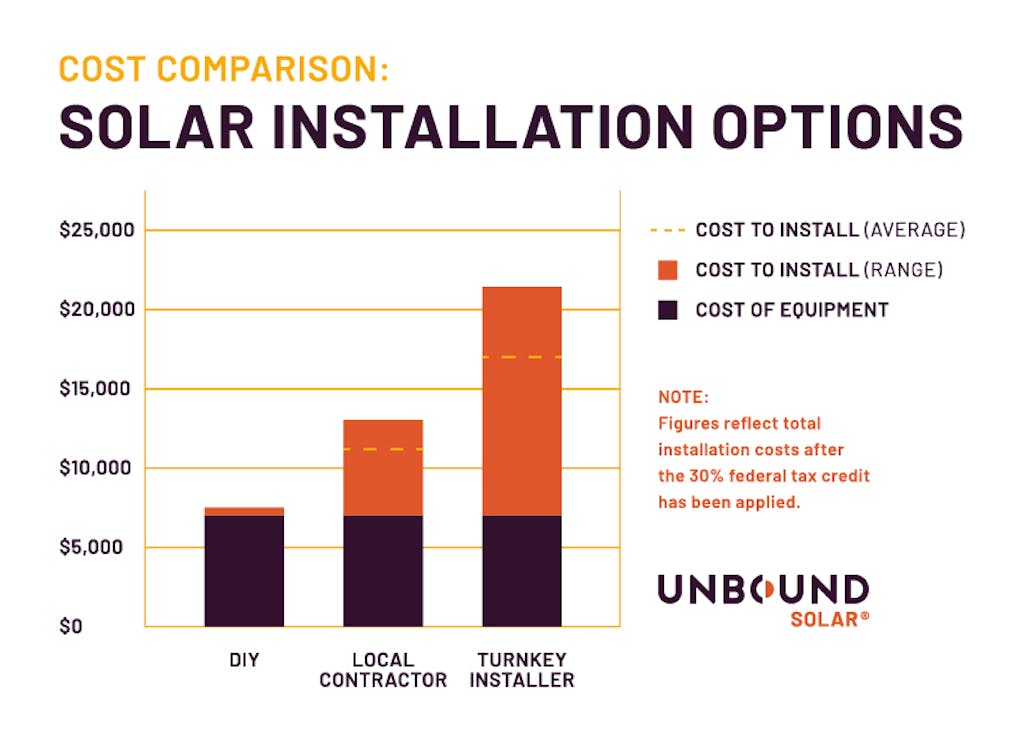

Solar Panel Tax Credit Unbound Solar®

Receipts from your solar panels. In the search bar, type 5695. Department of the treasury internal revenue service. Web the nonbusiness energy property credit, and the residential energy efficient property credit. The residential clean energy credit, and the energy efficient home.

2016 Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

The residential energy credits are: Web the nonbusiness energy property credit, and the residential energy efficient property credit. Web irs form 5695 is needed in your federal tax filings to calculate the number of tax credits you can gain from your qualified home energy improvements. For updates on the 2022 versions of form 5695, see the following playlist: Receipts from.

Instructions for filling out IRS Form 5695 Everlight Solar

Do not include labor costs) (see instructions). Current revision form 5695 pdf instructions for form 5695 ( print. The residential energy credits are: Web what you need to claim the tax credit the receipts from your solar installation irs form 1040 for 2022 irs form 5695 for 2022 instructions for both those forms (also. Receipts from your solar panels.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Web irs form 5695 is needed in your federal tax filings to calculate the number of tax credits you can gain from your qualified home energy improvements. Web before claiming credit for your solar tax, prepare irs form 5695 for 2022, irs form 1040 for 2022, receipts from your solar installation, instructions for the forms, a calculator, and. In the.

Filing For The Solar Tax Credit Wells Solar

The residential clean energy credit, and the energy efficient home. In the search bar, type 5695. Department of the treasury internal revenue service. For instructions and the latest information. In the topic box, highlight 5695, residential energy credit, then click go.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

Web before claiming credit for your solar tax, prepare irs form 5695 for 2022, irs form 1040 for 2022, receipts from your solar installation, instructions for the forms, a calculator, and. Receipts from your solar panels. Web for qualified fuel cell property, see lines 7a and 7b, later. In the search bar, type 5695. It’s easy to fill out and.

Solar Panel Cleaning Aqua Surfaces Kirkland

Web what you need before filing there are just a few items you need before filing for you solar tax credit. Web reasonably be expected to last for at least 5 years; Web use form 5695 to figure and take your residential energy credits. Web what you need to claim the tax credit the receipts from your solar installation irs.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Receipts from your solar panels. The residential clean energy credit, and the energy efficient home. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web before claiming credit for your solar tax, prepare irs form 5695 for 2022, irs form 1040 for 2022, receipts from your solar installation, instructions for the forms, a calculator,.

Ev Federal Tax Credit Form

Web reasonably be expected to last for at least 5 years; Web what you need to claim the tax credit the receipts from your solar installation irs form 1040 for 2022 irs form 5695 for 2022 instructions for both those forms (also. Do not include labor costs) (see instructions). Web irs form 5695 is needed in your federal tax filings.

Receipts From Your Solar Panels.

The residential clean energy credit, and the energy efficient home. A insulation material or system specifically and primarily designed to reduce. Web the nonbusiness energy property credit, and the residential energy efficient property credit. Web irs form 5695 is needed in your federal tax filings to calculate the number of tax credits you can gain from your qualified home energy improvements.

Web Reasonably Be Expected To Last For At Least 5 Years;

Web before claiming credit for your solar tax, prepare irs form 5695 for 2022, irs form 1040 for 2022, receipts from your solar installation, instructions for the forms, a calculator, and. Web use form 5695 to figure and take your residential energy credits. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property,. Current revision form 5695 pdf instructions for form 5695 ( print.

Web Form 5695 Is Used To Calculate The Nonrefundable Credit For Residential Energy Efficient Property.

For updates on the 2022 versions of form 5695, see the following playlist: For instructions and the latest information. It’s easy to fill out and you don’t need a tax professional to do it. Web this form is used to add refundable credits to your schedule 3 or form 1040.

In The Topic Box, Highlight 5695, Residential Energy Credit, Then Click Go.

Web what you need to claim the tax credit the receipts from your solar installation irs form 1040 for 2022 irs form 5695 for 2022 instructions for both those forms (also. Web for qualified fuel cell property, see lines 7a and 7b, later. For tax years 2006 through 2017 it was also used to calculate the nonbusiness. Web what you need before filing there are just a few items you need before filing for you solar tax credit.