Maryland 1099 Form

Maryland 1099 Form - Our secure, confidential website will provide your form 1099. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at taxhelp@marylandtaxes.gov or by phone at 410. Web to get a refund of maryland income taxes withheld, you must file a maryland return complete registration page(if first time user) complete information on income page for:. Web maryland continues to participate in the combined federal/state filing program for forms 1099. Upload, modify or create forms. Web maryland department of labor File the state copy of form 1099 with the maryland taxation agency by. If you received ui benefits in maryland, the 1099. Web i got form 1099g. Web yes, maryland requires all 1099 forms to be filed with the comptroller of maryland.

Try it for free now! Learn more about how to simplify your businesses 1099 reporting. Maryland also mandates the filing of form mw508, annual. Web yes, maryland requires all 1099 forms to be filed with the comptroller of maryland. Find them all in one convenient place. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at taxhelp@marylandtaxes.gov or by phone at 410. File the state copy of form 1099 with the maryland taxation agency by. Ad success starts with the right supplies. If you received a maryland income tax refund last year, we're required by federal law to send. Which forms does maryland require?

Upload, modify or create forms. Web file the following forms with the state of maryland: The comptroller of maryland is encouraging you to sign up to go paperless this tax season. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. File the state copy of form 1099 with the maryland taxation agency by. It is not a bill. Which forms does maryland require? Web yes, maryland requires all 1099 forms to be filed with the comptroller of maryland. Ad success starts with the right supplies. Web maryland department of labor

How Not To Deal With A Bad 1099

Web maryland department of labor Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Which forms does maryland require? If you received ui benefits in maryland, the 1099. Web maryland continues to participate in the combined federal/state filing program for forms 1099.

What is a 1099Misc Form? Financial Strategy Center

Learn more about how to simplify your businesses 1099 reporting. Our secure, confidential website will provide your form 1099. If you received ui benefits in maryland, the 1099. File the state copy of form 1099 with the maryland taxation agency by. If you received a maryland income tax refund last year, we're required by federal law to send.

Printable 1099 Tax Forms Free Printable Form 2022

Our secure, confidential website will provide your form 1099. Web yes, maryland requires all 1099 forms to be filed with the comptroller of maryland. The fastest way to obtain a. Prior to your submission to combined federal/state filing, the 1099 file must. Web maryland department of labor

Free Printable 1099 Misc Forms Free Printable

The fastest way to obtain a. This refund, offset or credit may be taxable income. If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. Learn more about how to simplify your businesses 1099 reporting. Web for assistance, users may contact the taxpayer service section monday through friday from.

How To File Form 1099NEC For Contractors You Employ VacationLord

Web to get a refund of maryland income taxes withheld, you must file a maryland return complete registration page(if first time user) complete information on income page for:. Try it for free now! Learn more about how to simplify your businesses 1099 reporting. Ad use readymade templates to report your payments without installing any software. Which forms does maryland require?

Businesses have Feb. 1 deadline to provide Forms 1099MISC and 1099NEC

Which forms does maryland require? Ad success starts with the right supplies. If you received ui benefits in maryland, the 1099. Web yes, maryland requires all 1099 forms to be filed with the comptroller of maryland. Try it for free now!

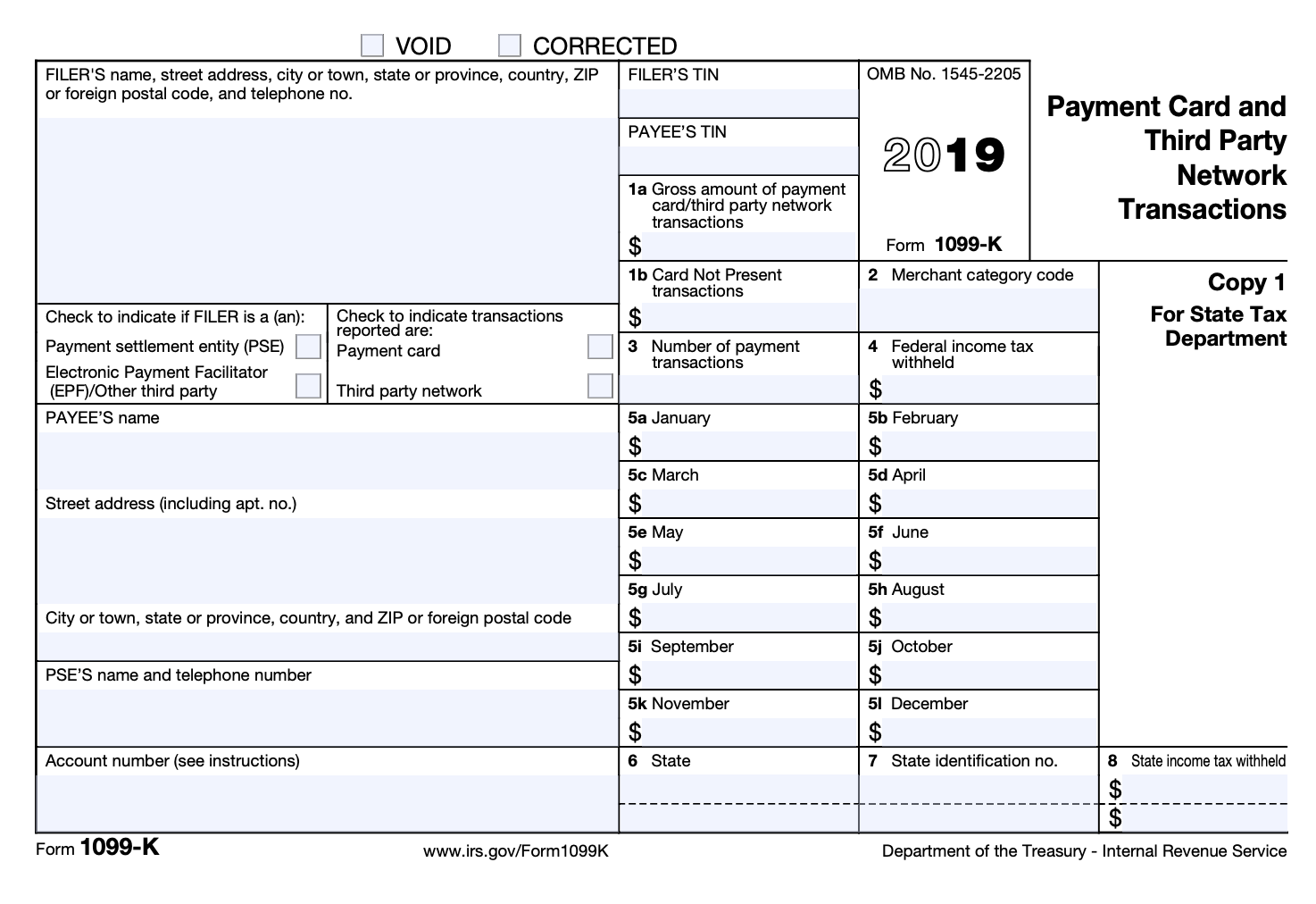

When is tax form 1099MISC due to contractors? GoDaddy Blog

Upload, modify or create forms. Learn more about how to simplify your businesses 1099 reporting. Ad success starts with the right supplies. From the latest tech to workspace faves, find just what you need at office depot®! The comptroller of maryland is encouraging you to sign up to go paperless this tax season.

1099 S Form Fill Online, Printable, Fillable, Blank pdfFiller

Web maryland continues to participate in the combined federal/state filing program for forms 1099. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Prior to your submission to combined federal/state filing, the 1099 file must. Web to get a refund of maryland income taxes withheld, you must file a maryland return complete registration page(if.

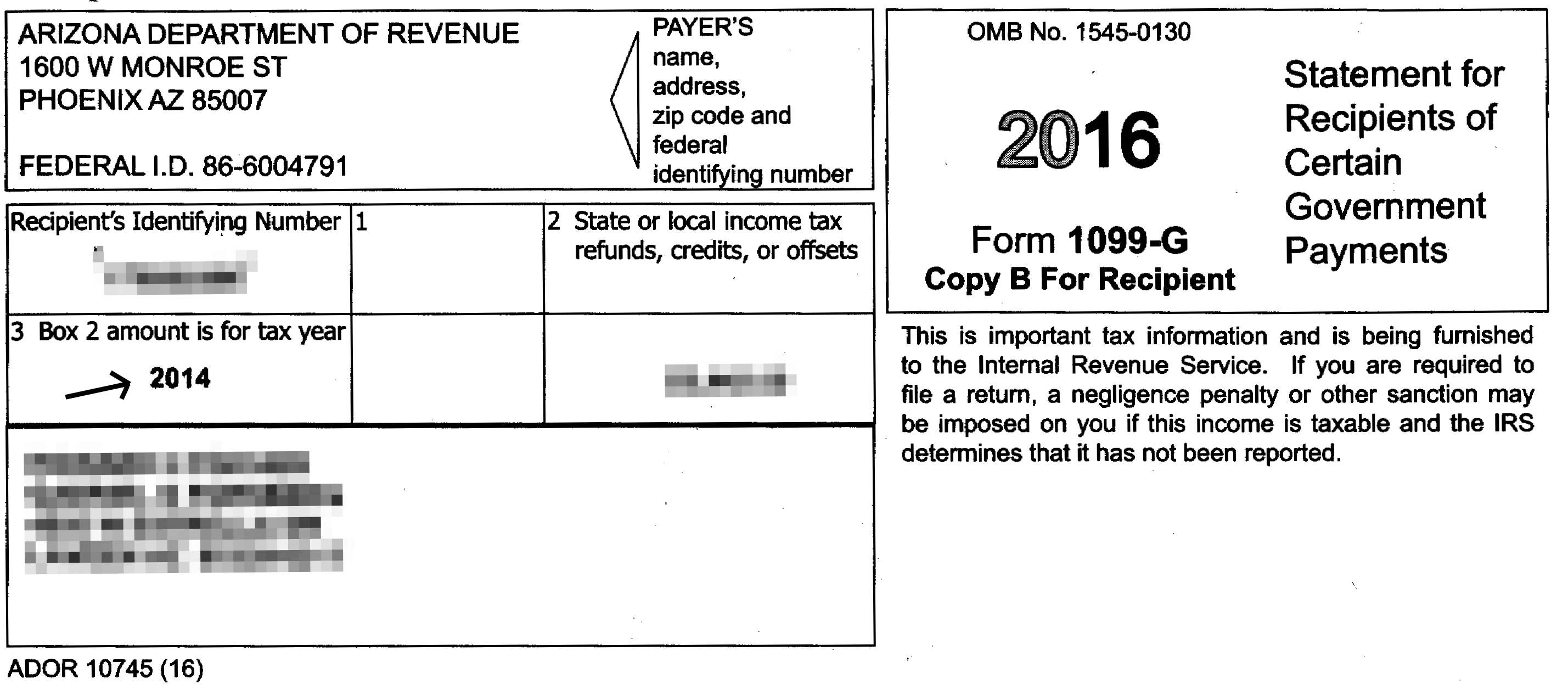

Hold up on doing your taxes; Arizona tax form 1099G is flawed The

Our secure, confidential website will provide your form 1099. File the state copy of form 1099 with the maryland taxation agency by. Which forms does maryland require? If you received a maryland income tax refund last year, we're required by federal law to send. Upload, modify or create forms.

1099 Misc Downloadable Form Universal Network

Web yes, maryland requires all 1099 forms to be filed with the comptroller of maryland. Prior to your submission to combined federal/state filing, the 1099 file must. Web maryland department of labor Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at taxhelp@marylandtaxes.gov or by phone at 410..

The Fastest Way To Obtain A.

Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit. Which forms does maryland require? Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. It is not a bill.

If You Received A Maryland Income Tax Refund Last Year, We're Required By Federal Law To Send.

The comptroller of maryland is encouraging you to sign up to go paperless this tax season. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at taxhelp@marylandtaxes.gov or by phone at 410. From the latest tech to workspace faves, find just what you need at office depot®! Web maryland department of labor

This Refund, Offset Or Credit May Be Taxable Income.

Web maryland continues to participate in the combined federal/state filing program for forms 1099. Maryland also mandates the filing of form mw508, annual. Ad success starts with the right supplies. Ad use readymade templates to report your payments without installing any software.

Web Comptroller Of Maryland's Www.marylandtaxes.gov All The Information You Need For Your Tax Paying Needs

Upload, modify or create forms. Web to get a refund of maryland income taxes withheld, you must file a maryland return complete registration page(if first time user) complete information on income page for:. Find them all in one convenient place. If you received ui benefits in maryland, the 1099.