Small Estate Affidavit California Form

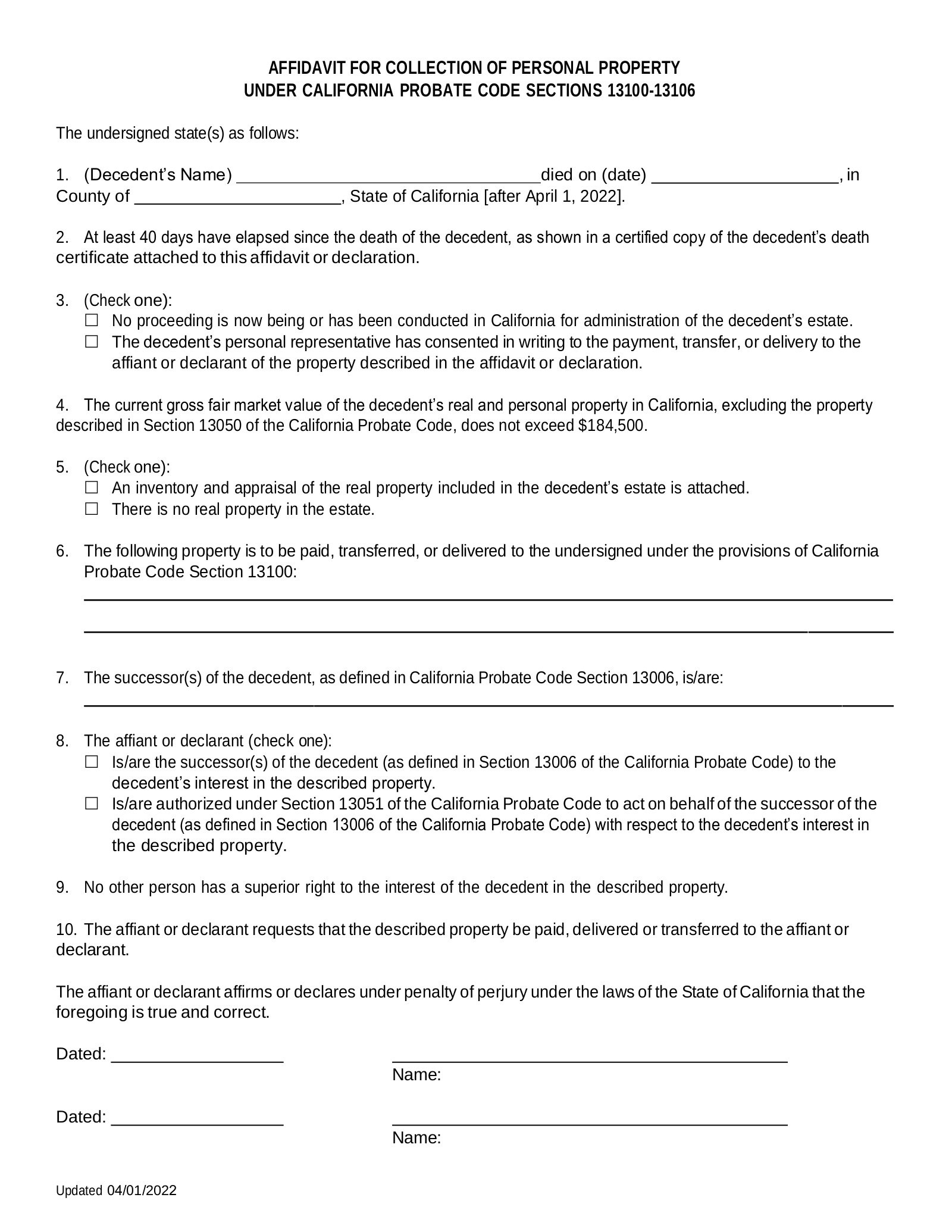

Small Estate Affidavit California Form - There is a special form for this that you can get from most banks and lawyers. You give this affidavit to the person, company, or financial institution (such as a bank) that has the property so that they can legally transfer it to your name. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer personal property by writing an affidavit. The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate. All real and personal property that a person owned at the time of death. Web a california small estate affidavit, or “petition to determine succession to real property,” is used by the rightful heirs to an estate of a person who died (the “decedent”). People who qualify include a beneficiary in the deceased's will and the guardian or conservator of the estate. Web property described in section 13050 of the california probate code, does not exceed one hundred sixty six thousand two hundred fifty dollars ($166,250) if decedent died before april 1, 2022 or one hundred eighty four thousand five hundred dollars ($184,500) if decedent died on or after april 1, 2022. No other person has a superior right to the interest of the decedent in the described property. Web this packet contains the judicial council forms required to initiate a formal probate proceeding for a decedent's estate.

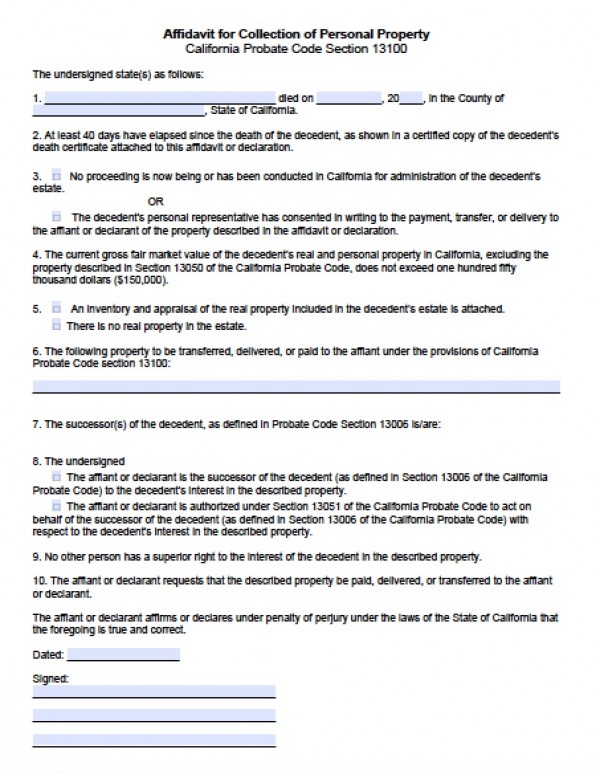

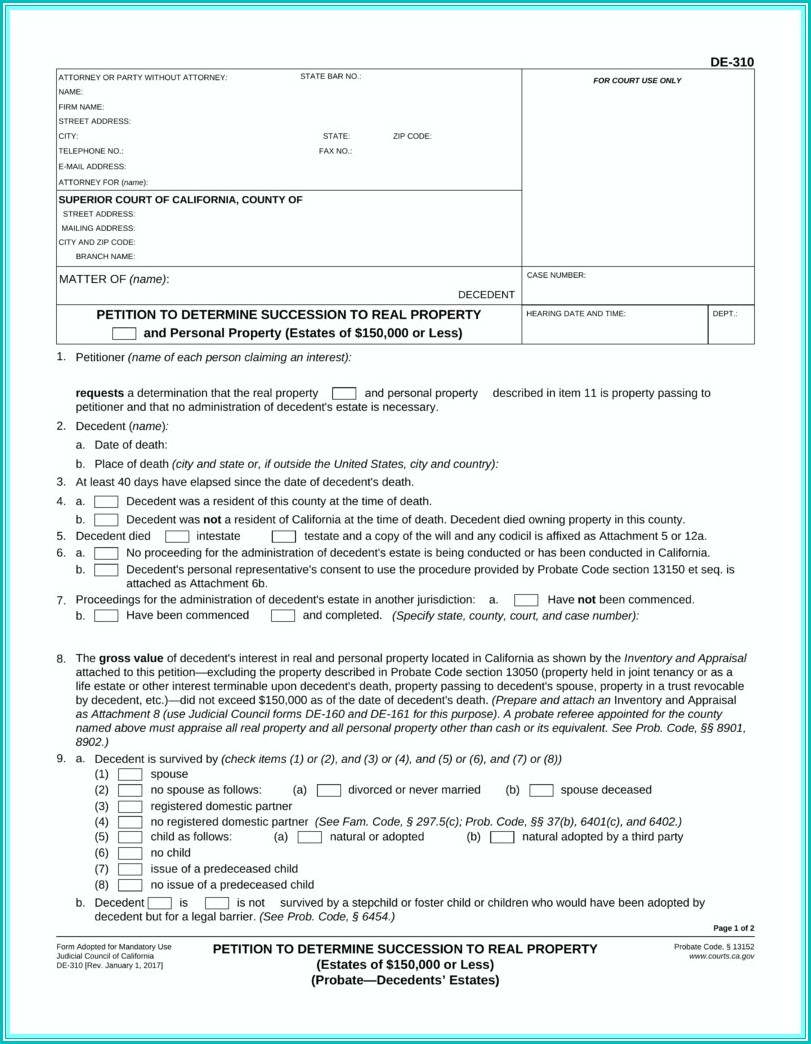

Web a california small estate affidavit, or “petition to determine succession to real property,” is used by the rightful heirs to an estate of a person who died (the “decedent”). Web this packet contains the judicial council forms required to initiate a formal probate proceeding for a decedent's estate. Family members that file a small estate affidavit to claim heirship of their deceased loved one’s real estate use these forms to avoid probate court. Web the final total must not exceed $150,000 in order to qualify for the california small estate affidavit form. People who qualify include a beneficiary in the deceased's will and the guardian or conservator of the estate. Superior courts typically have local rules in addition to the california rules of court. Web property described in section 13050 of the california probate code, does not exceed one hundred sixty six thousand two hundred fifty dollars ($166,250) if decedent died before april 1, 2022 or one hundred eighty four thousand five hundred dollars ($184,500) if decedent died on or after april 1, 2022. The gross total value of the estate may not exceed $184,500, including unpaid wages. Your qualification you're entitled to use the small estate procedure if you have a legal right to inherit from the deceased. Estate 05/01/2023 small estate affidavit overview decedent’s estate refers to all property left behind when a person dies.

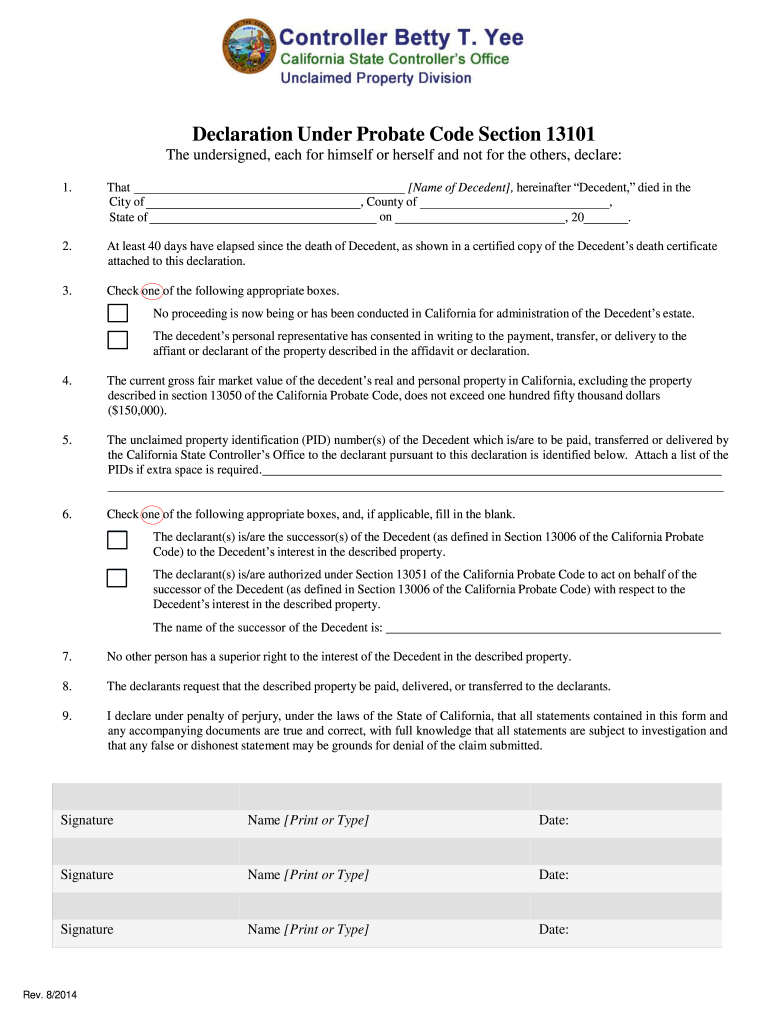

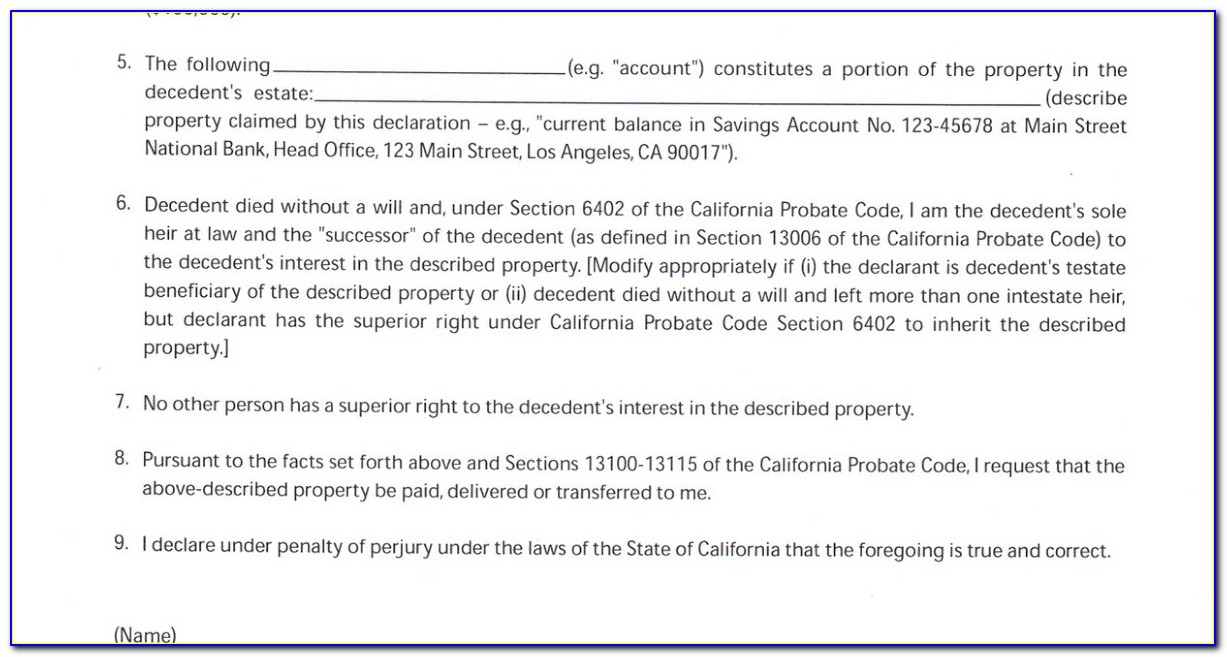

Web the final total must not exceed $150,000 in order to qualify for the california small estate affidavit form. You give this affidavit to the person, company, or financial institution (such as a bank) that has the property so that they can legally transfer it to your name. Web is/are authorized under section 13051 of the california probate code to act on behalf of the successor of the decedent (as defined in section 13006 of the california probate code) with respect to the decedent’s interest in the described property. Web this packet contains the judicial council forms required to initiate a formal probate proceeding for a decedent's estate. Your qualification you're entitled to use the small estate procedure if you have a legal right to inherit from the deceased. The gross total value of the estate may not exceed $184,500, including unpaid wages. Web for a complete list, see california probate code section 13050. Probate small estate affidavit packet (.zip) 3mb this packet contains forms for qualifying small estate affidavits. The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate. Web california small estate affidavit.

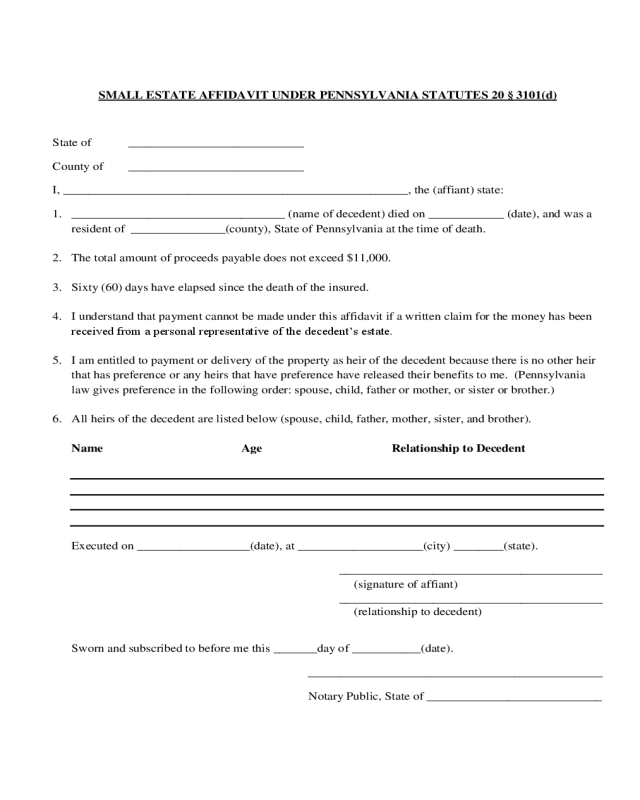

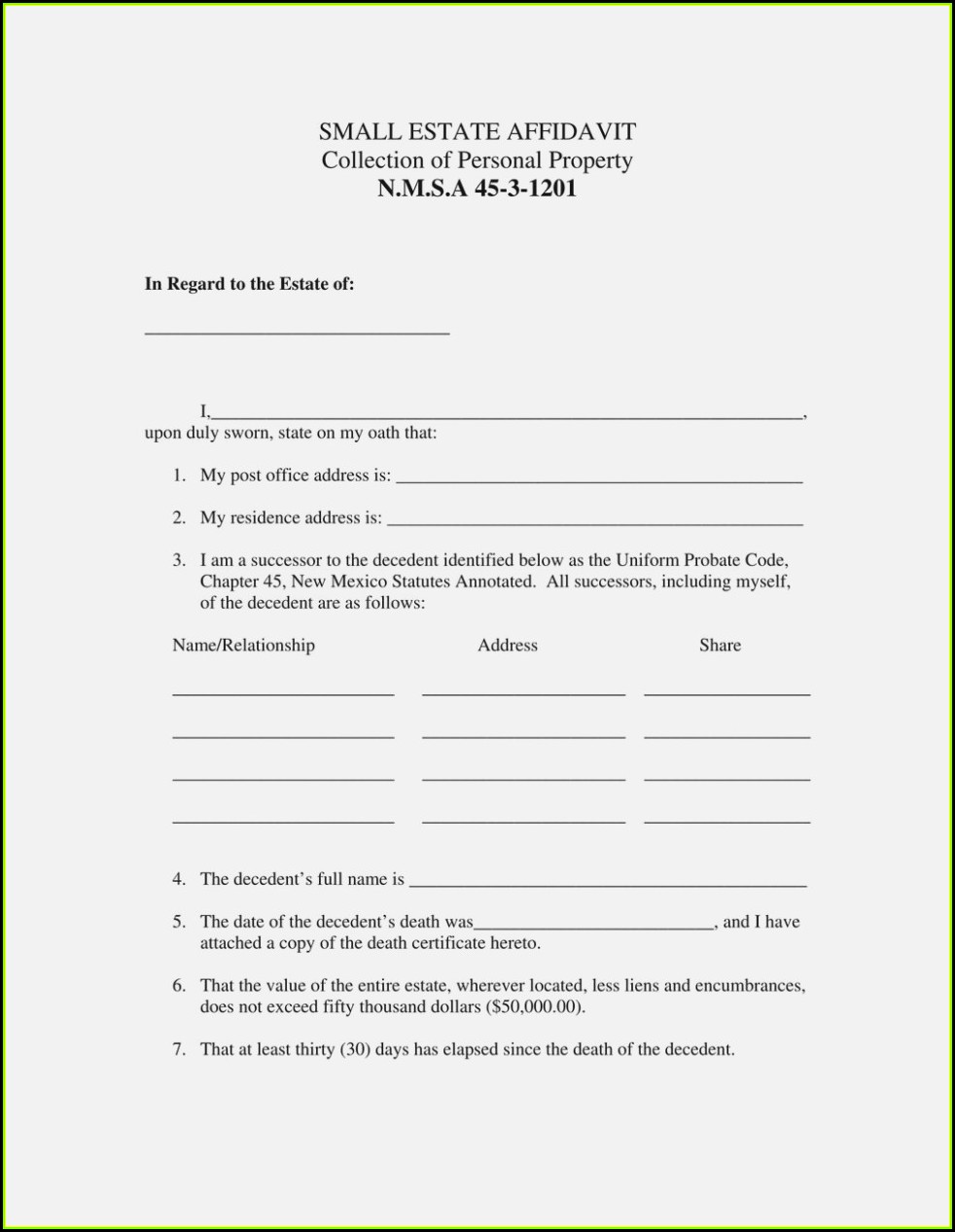

Printable Small Estate Affidavit Form Master of Documents

All real and personal property that a person owned at the time of death. You give this affidavit to the person, company, or financial institution (such as a bank) that has the property so that they can legally transfer it to your name. Superior courts typically have local rules in addition to the california rules of court. This packet will.

Free California Small Estate Affidavit Form PDF Word

Web california small estate affidavit. Web this packet contains the judicial council forms required to initiate a formal probate proceeding for a decedent's estate. Web for a complete list, see california probate code section 13050. Superior courts typically have local rules in addition to the california rules of court. You give this affidavit to the person, company, or financial institution.

Small Estate Affidavit California Form 13101 Fill Online, Printable

Web property described in section 13050 of the california probate code, does not exceed one hundred sixty six thousand two hundred fifty dollars ($166,250) if decedent died before april 1, 2022 or one hundred eighty four thousand five hundred dollars ($184,500) if decedent died on or after april 1, 2022. People who qualify include a beneficiary in the deceased's will.

Small Estate Affidavit California Probate Code 13100 Form Resume

Your qualification you're entitled to use the small estate procedure if you have a legal right to inherit from the deceased. Web for a complete list, see california probate code section 13050. Web you may be able to use a small estate affidavit to have the property transferred to you. Superior courts typically have local rules in addition to the.

Small Estate Affidavit California Form De 310 Form Resume Examples

Estate 05/01/2023 small estate affidavit overview decedent’s estate refers to all property left behind when a person dies. Probate small estate affidavit packet (.zip) 3mb this packet contains forms for qualifying small estate affidavits. There is a special form for this that you can get from most banks and lawyers. People who qualify include a beneficiary in the deceased's will.

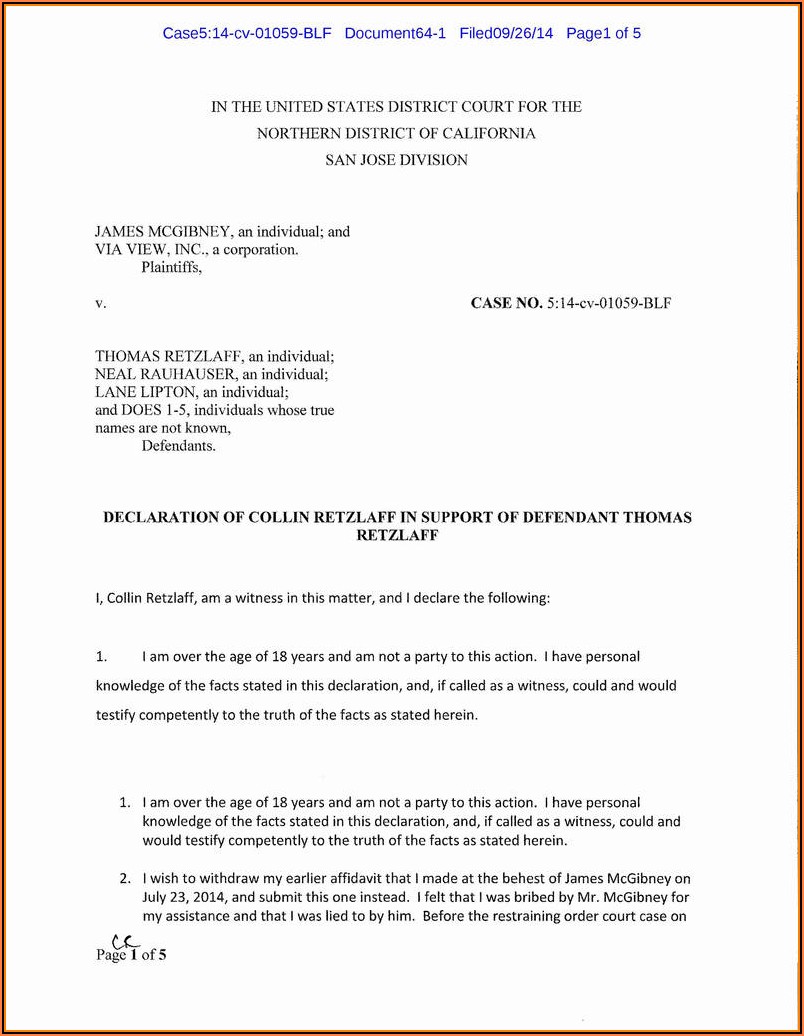

Notary Affidavit Form California Form Resume Examples QJ9elz8K2m

Web is/are authorized under section 13051 of the california probate code to act on behalf of the successor of the decedent (as defined in section 13006 of the california probate code) with respect to the decedent’s interest in the described property. Family members that file a small estate affidavit to claim heirship of their deceased loved one’s real estate use.

Free Affidavit Of Non Prosecution Form California Form Resume

If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer personal property by writing an affidavit. Web california small estate affidavit. Web you may be able to use a small estate affidavit to have the property transferred to you. Superior courts typically have local rules in addition to.

Small Estate Affidavit California Probate Code 13100 Form Resume

Family members that file a small estate affidavit to claim heirship of their deceased loved one’s real estate use these forms to avoid probate court. Web a california small estate affidavit, or “petition to determine succession to real property,” is used by the rightful heirs to an estate of a person who died (the “decedent”). Web the final total must.

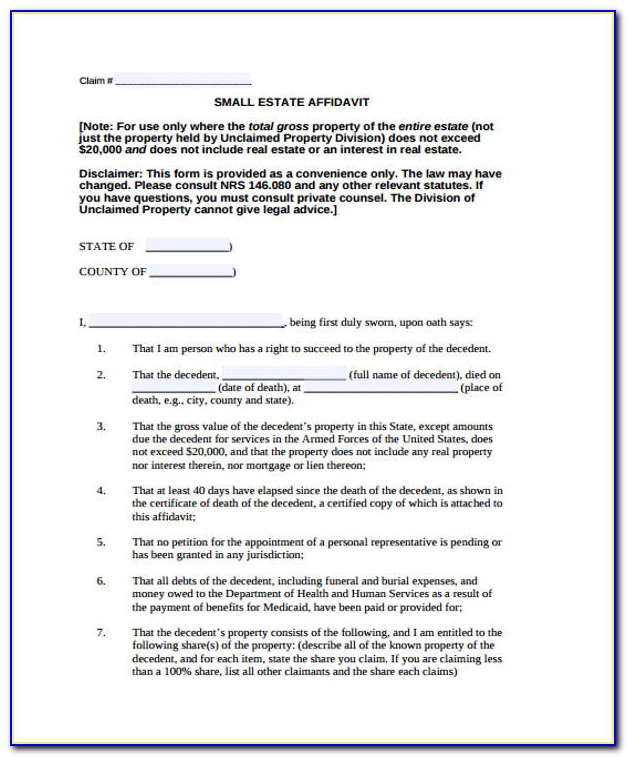

Small Estate Affidavit Form Bexar County Texas Universal Network

People who qualify include a beneficiary in the deceased's will and the guardian or conservator of the estate. Superior courts typically have local rules in addition to the california rules of court. The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate. Your qualification you're entitled to use.

Free California Small Estate Affidavit (Affidavit for Collection of

Family members that file a small estate affidavit to claim heirship of their deceased loved one’s real estate use these forms to avoid probate court. No other person has a superior right to the interest of the decedent in the described property. You give this affidavit to the person, company, or financial institution (such as a bank) that has the.

No Other Person Has A Superior Right To The Interest Of The Decedent In The Described Property.

Web this packet contains the judicial council forms required to initiate a formal probate proceeding for a decedent's estate. Web california small estate affidavit. People who qualify include a beneficiary in the deceased's will and the guardian or conservator of the estate. The gross total value of the estate may not exceed $184,500, including unpaid wages.

Superior Courts Typically Have Local Rules In Addition To The California Rules Of Court.

Web the final total must not exceed $150,000 in order to qualify for the california small estate affidavit form. This packet will cover how to access the decedent's property using a small estate affidavit. The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate. Web a california small estate affidavit, or “petition to determine succession to real property,” is used by the rightful heirs to an estate of a person who died (the “decedent”).

Web For A Complete List, See California Probate Code Section 13050.

Web property described in section 13050 of the california probate code, does not exceed one hundred sixty six thousand two hundred fifty dollars ($166,250) if decedent died before april 1, 2022 or one hundred eighty four thousand five hundred dollars ($184,500) if decedent died on or after april 1, 2022. Family members that file a small estate affidavit to claim heirship of their deceased loved one’s real estate use these forms to avoid probate court. Web you may be able to use a small estate affidavit to have the property transferred to you. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer personal property by writing an affidavit.

Estate 05/01/2023 Small Estate Affidavit Overview Decedent’s Estate Refers To All Property Left Behind When A Person Dies.

Web is/are authorized under section 13051 of the california probate code to act on behalf of the successor of the decedent (as defined in section 13006 of the california probate code) with respect to the decedent’s interest in the described property. You give this affidavit to the person, company, or financial institution (such as a bank) that has the property so that they can legally transfer it to your name. Probate small estate affidavit packet (.zip) 3mb this packet contains forms for qualifying small estate affidavits. All real and personal property that a person owned at the time of death.